The war in Ukraine and the energy sanctions imposed on Russia have further bolstered the drive to invest in renewable energy sources. In response, major market players such as China, the EU, and the US have recently updated their industry development strategies to effectively compete in the expanding market. It is predicted that renewables will surpass coal as the world's primary source of electricity by 2025. However, the surge in investment has also been accompanied by political agendas, as each player seeks not only to achieve energy independence but also to enhance their political power, if possible.

Content

Solar panel market: Chinese dominance

U.S. Response: Technological Protectionism

Resistance and criticism from the European Union

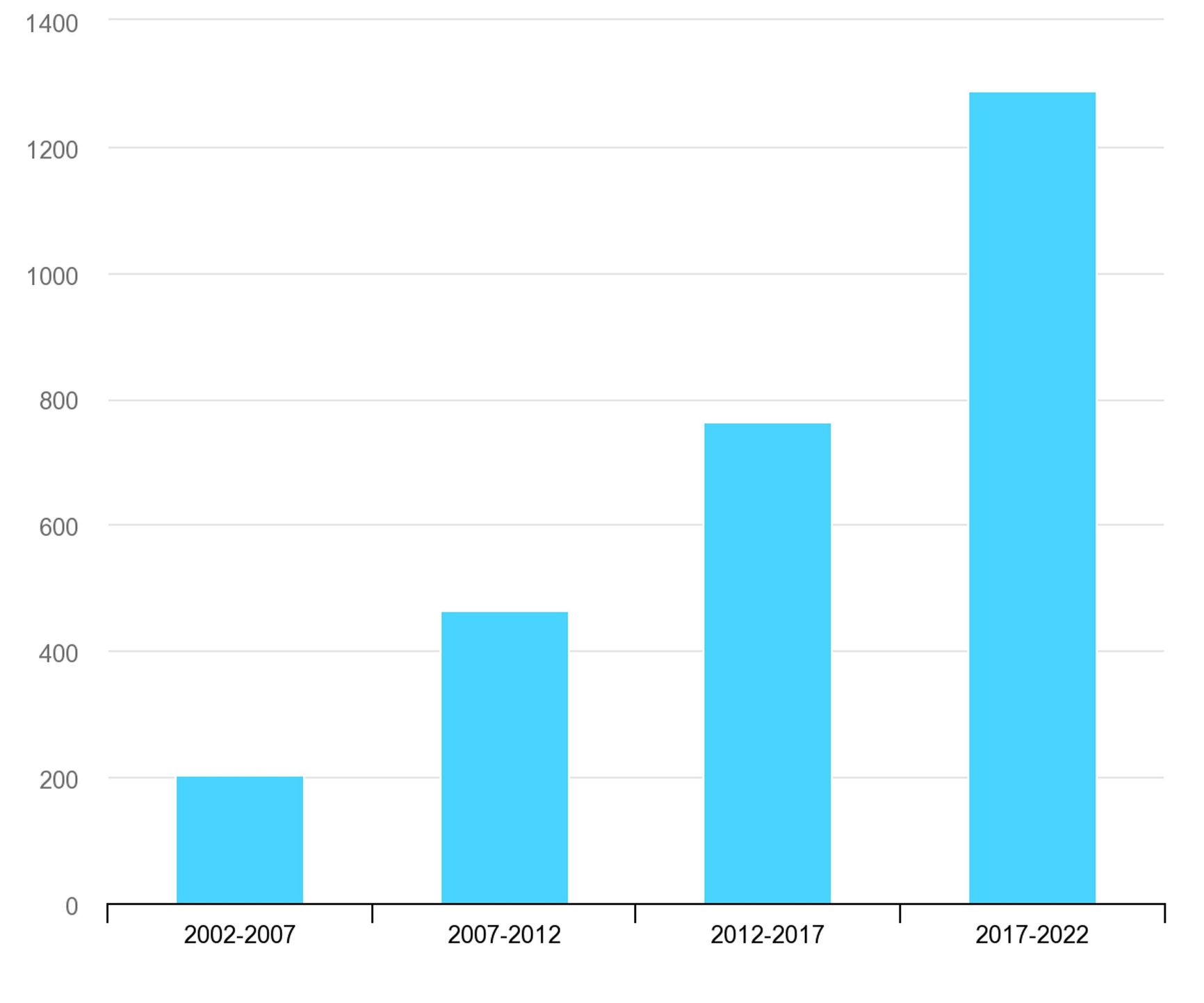

Following Russia's full-scale invasion of Ukraine, the transition from hydrocarbons to renewable energy sources (RES) has accelerated significantly worldwide. In 2022, the transition rate surpassed expectations by 30%. The global RES capacity is expected to increase by 2,400 GW between 2022 and 2027, equivalent to China's current capacity. By the beginning of 2025, RES is forecast to surpass coal as the largest source of electricity in the world. Investment in the industry is also increasing, with global investments in technologies reaching $1.3 trillion in 2022, according to estimates by IRENA. The International Energy Agency (IEA) predicts that this figure will exceed $2 trillion by 2030.

The war and oil embargo have further hastened the shift towards renewable energy, which has drawn increasing attention in recent times. In the past two years, all major global economic players have declared their intentions to achieve zero carbon emissions by 2050-2060, enshrining these goals in policy documents and laws. This commitment entails significant government investments in renewable energy and support for this sector.

World renewable energy capacity commissioning in 2002-2022, GW IEA

Investment in renewable energy has two main objectives. The first is to serve the common good and mitigate climate change. The second objective is to secure a place in the expanding and promising “green” market, exert influence, and, crucially, maintain energy security. Energy security has been and remains a significant driving force behind the development of green technologies.

Solar panel market: Chinese dominance

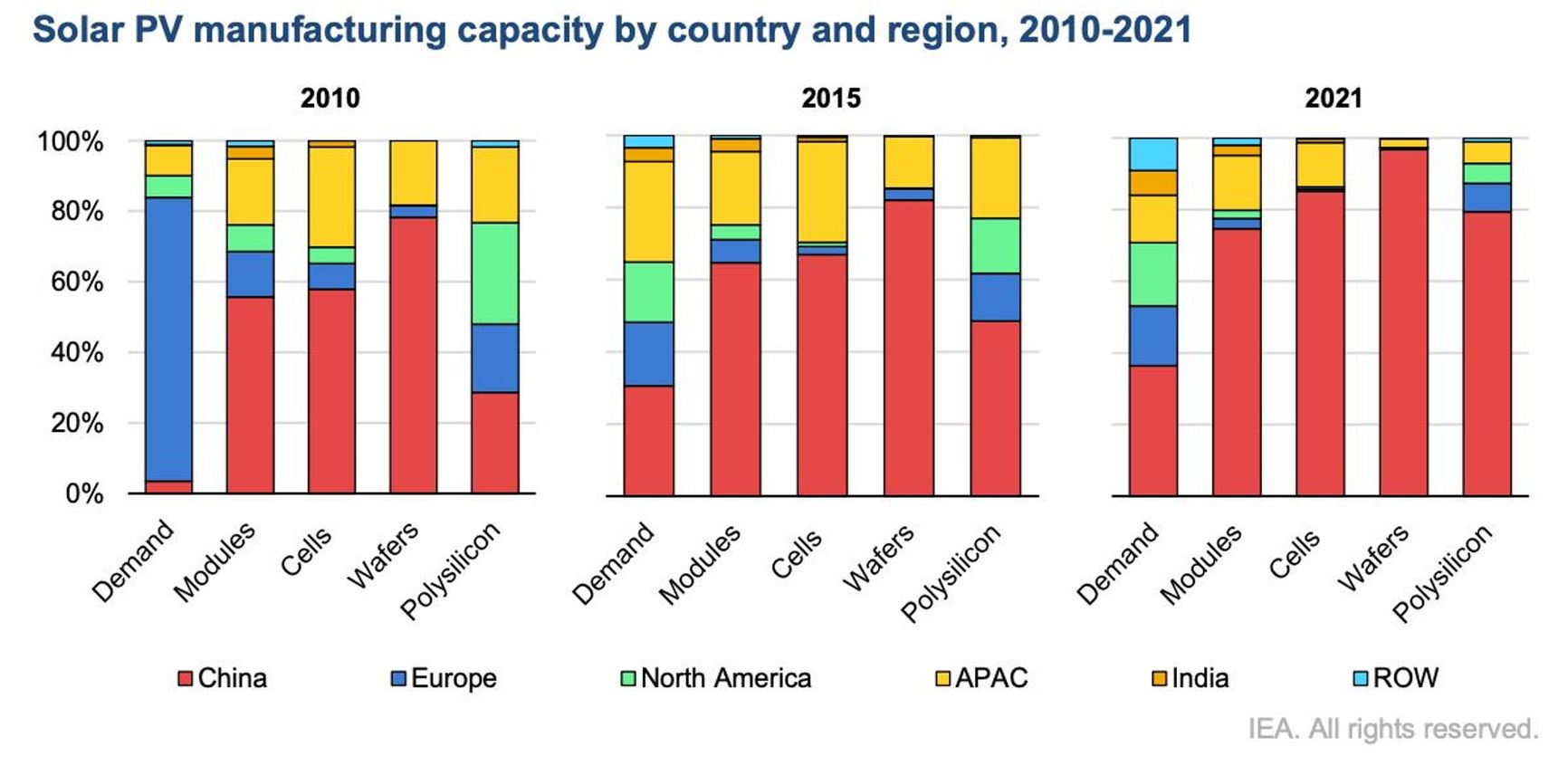

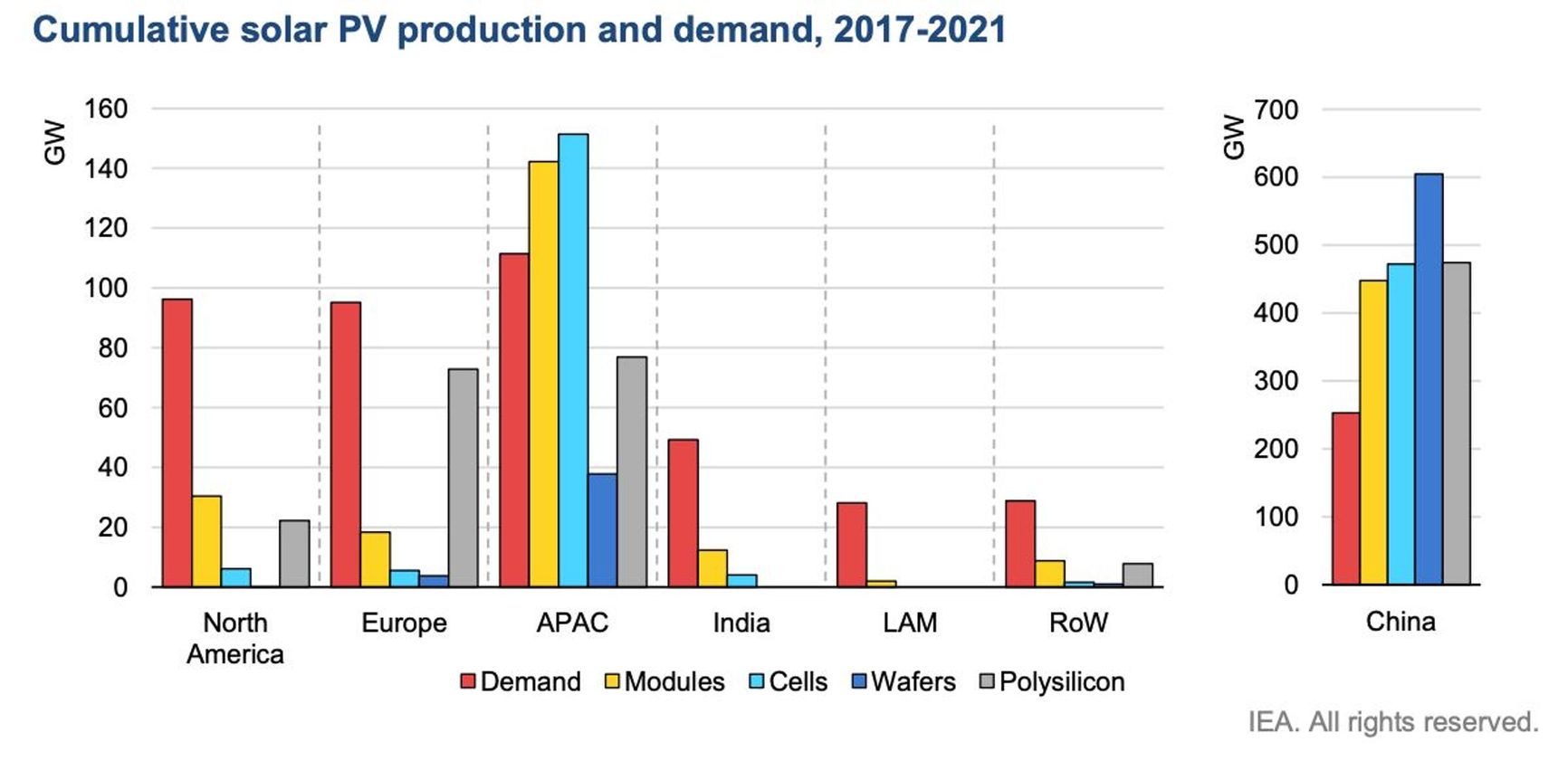

In July 2022, the IEA issued a report on the threat of China's dominance in the solar panel market. The organization's concerns stem from the fact that some of the links in the production chain are almost entirely dependent on Chinese companies.

According to the report, the country's share of all stages of solar panel production now exceeds 80%, and for key elements, including polysilicon and wafers, will rise to more than 95% in the coming years, based on the amount of production capacity being prepared for launch.

In addition, China had about 70% of the wind turbine market in 2022 and controlled more than 70% of lithium processing capacity and 50% of nickel processing capacity, according to S&P Platts.

The concerns of market players are not limited to China's potential dominance in the market and its ability to impose conditions; they also extend to issues like production and supply chain disruptions caused by unforeseen events such as lockdowns, floods, or factory fires. According to the report, the high prices of raw materials and existing supply chain bottlenecks have resulted in a 20% surge in solar panel prices during 2021-2022, as well as global delivery delays.

China's rise to dominance in the solar panel market, as well as in the renewable energy sector as a whole, was not an overnight occurrence. The process began in the 1990s when major hydrocarbon importers initiated research into renewable energy sources and began subsidizing their use in households. The production of solar panels, wind turbines, and their components was initially expensive in developed countries such as the USA, Japan, Germany, and Italy, and subsidies and feed-in tariffs helped create demand among end-users. Chinese companies were quick to respond to this shortage by expanding their production capacity and increasing supplies to the US and European markets, capitalizing on the opportunity.

In the beginning, China acquired technology licenses from Western companies and implemented them under supervision. However, as the market volume grew in the mid-2000s, Chinese shareholders began to buy shares from foreign investors and push them out of the local market. For instance, in 2008, Goldwind acquired 70% of shares in the German company Vensys. Additionally, in the solar energy market, China invested heavily in its own development, building test sites and subsidizing companies in the industry. Consequently, Chinese companies today possess a number of unique technologies.

Chinese companies today possess a number of unique technologies

The development of renewable energy in China is taking place in accordance with the “Five-Year Plan.” The current plan (2021-2025) involves laying the foundation for the country's energy transition, achieving peak emissions by 2030 and carbon neutrality by 2060.

The 14th Five-Year Plan is expected to result in China accounting for nearly half of the new global renewable energy capacity between now and 2025, while the country's own clean energy production is expected to grow by 50% by the end of the five-year period.

The level of Chinese funding for the renewable energy industry is commensurate with its ambitious plans. BloombergNEF's analysis shows that in 2022, China contributed almost half of the world's investment in low-carbon projects, amounting to $546 billion. This figure is nearly four times higher than the US's investment, which was only $141 billion. The European Union ranked second, investing $180 billion in energy transition projects.

It is worth noting, however, that despite such significant financial support for the industry, China remains the largest global emitter of carbon dioxide. Furthermore, coal will remain a critical component of the country's energy policy for the next decade, which is expected to mitigate the risks of power outages in a system where the proportion of renewables is increasing.

U.S. Response: Technological Protectionism

In the summer of 2022, the IEA published a report on the potential threat of Chinese domination in the solar panel market. Merely two months later, US President Joe Biden signed the groundbreaking Inflation Reduction Act (IRA), aimed at promoting the growth of the green energy market in the US. The Act is intended to incentivize investors to invest in American renewable energy projects and give local companies preferential treatment over foreign competitors.

The US government has committed to providing approximately $737 billion in public funding, with $369 billion allocated for subsidies to support the clean energy sector. These subsidies are directed towards electric vehicles (EVs) and batteries, hydrogen, electricity storage and transmission technologies, and supply chain diversification. However, one crucial requirement is that production must be based in the United States. As a result, China's share of production capacity could shrink by 10-15% by 2027, though it will continue to be the dominant player. In turn, the US must enhance its share.

The Inflation Reduction Act will work on two levels at once – local and global. Locally, the Biden administration aims to revive U.S. manufacturing, which it believes has weakened U.S. security and hurt the economy due to competition with China. The loss of manufacturing jobs has also undermined voter support for Democrats in swing industrial states such as Michigan, Pennsylvania and Wisconsin. Globally, the U.S. wants to build a reliable supply chain that reduces China’s role in supplying critical technologies and materials for green energy.

Biden said he wants the U.S. to “not only compete with China in the future but lead the world and win the economic competition of the 21st century.” To achieve this goal, the U.S. has launched several initiatives to boost its industries. Besides the Inflation Reduction Act, passed in August 2022, there is the CHIPS Act, which allocates $52.7 billion for research, development and production of semiconductors in the U.S. This has already attracted about $200 billion in investments from Taiwanese and U.S. semiconductor companies such as TSMC, Intel, Micron and IBM.

Resistance and criticism from the European Union

EU officials and businesses are outraged and baffled by the U.S. protectionist policy towards its own “green” market. The Inflation Reduction Act breaks WTO rules that ban any member country from favoring its own producers in the market. These rules have been in place for decades. Europe also bears much more losses from the Ukraine war and from stopping Russian hydrocarbon purchases. The third reason is the limited “response”: if the EU adopts a package of counter-subsidies, it will not only breach the same WTO rules, but also join a technological race with the U.S. that goes against its long-term geopolitical strategy and the idea of transatlantic energy security (especially in light of the Ukraine war and China’s rise).

Europe bears much more losses from the Ukraine war and from stopping Russian hydrocarbon purchases

In September 2022, European Commission President Ursula von der Leyen proposed the establishment of a new European sovereign fund and hydrogen bank, one month after the act had been signed. The following month, a dedicated bilateral group commenced discussions regarding the implications of the IRA for European manufacturers. Later in December, French President Emmanuel Macron visited Washington, where he personally requested his American counterpart to amend the bill.

The frustration regarding the IRA was amplified by various European energy companies considering investments in the U.S. or relocating their offices.

In early February, without seeing any significant relaxation of the U.S. act, the European Commission revealed a new strategy for promoting green energy. The plan centers on adapting to the EU's “strengths,” which include regulation, open markets, and external communication. As part of this strategy, companies will be able to acquire permits more quickly, subsidies will be available, and the labor market will receive additional specialists in the expanding industry. Additionally, the EU intends to establish strong international trade partnerships, notably with Mexico, New Zealand, Australia, and India.

Without seeing any significant relaxation of the U.S. act, the European Commission revealed a new strategy for promoting green energy

The plan entails the allocation of an additional €250 billion in addition to the already announced programs aimed at decarbonizing the EU.

The energy transition, which previously resembled a collective effort among developed countries to achieve climate objectives, can no longer be described as a “green flash mob” by 2023. In the past two tumultuous years, green energy has expanded to a global scale, where the increasing tension between the United States and China holds more sway than individual countries or regional trends. As Europe grapples with the ramifications of breaking energy ties with Russia, it may have to adopt a balancing role as a third party for the sake of resources, markets, and security.

Assuming that current levels of investment by both the United States and the European Union persist, it is improbable that the U.S. will surpass or even match the EU's dominance in the “green” technology market within the next ten years. Nevertheless, the U.S. can still achieve energy independence, a goal that was highly sought after during the era of fossil fuels, and localize crucial production chains within its borders through massive injections of capital.