As The Insider has discovered, Russia continues to freely import Taiwanese silicon for wafer plates, which serve as the basic component for the majority of all microchips made in the country. Such microchips are integral in the production of fighter jets, Iskander missiles, S-300 launchers, Pantsir surface-to-air missile systems, and other military equipment. If Taiwan curbs its export of crucial silicon, Russia’s military-industrial complex could face insurmountable difficulties.

Content

Russia's microchip production in detail

Military production

Raw materials from Taiwan for “Russia’s very own” microchips

Violation of sanctions

Russia's microchip production in detail

Modern microchip production is a complex technological process that no country in the world has been able to master domestically. The chip layout is usually developed by a U.S.-based fabless company such as Apple or Texas Instruments. The blueprints are then passed on to a foundry — an industrial manufacturer that does not design its own chips but implements customers’ designs. A single Taiwanese company, TSMC, holds a significant portion of the manufacturers' market, with U.S.-based Intel and Korea's Samsung, which fabricate chips in-house, representing the rare exceptions. Chip production depends on the supply of semiconductor lithography platforms, and the market for cutting-edge lithography equipment has essentially been monopolized by the Dutch company ASML, with Nikon and Canon holding a small share of this market.

Russia has tried to establish its own microchip production both on the fabless model and as a full cycle. Until recently, Taiwan accepted Russian orders for Baikal and Elbrus processors from Russian fabless manufacturers. However, TSMC stopped shipments to Russia following the outbreak of full-scale war.

Can Russia manufacture microchips domestically? It can for some varieties, but not for all.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

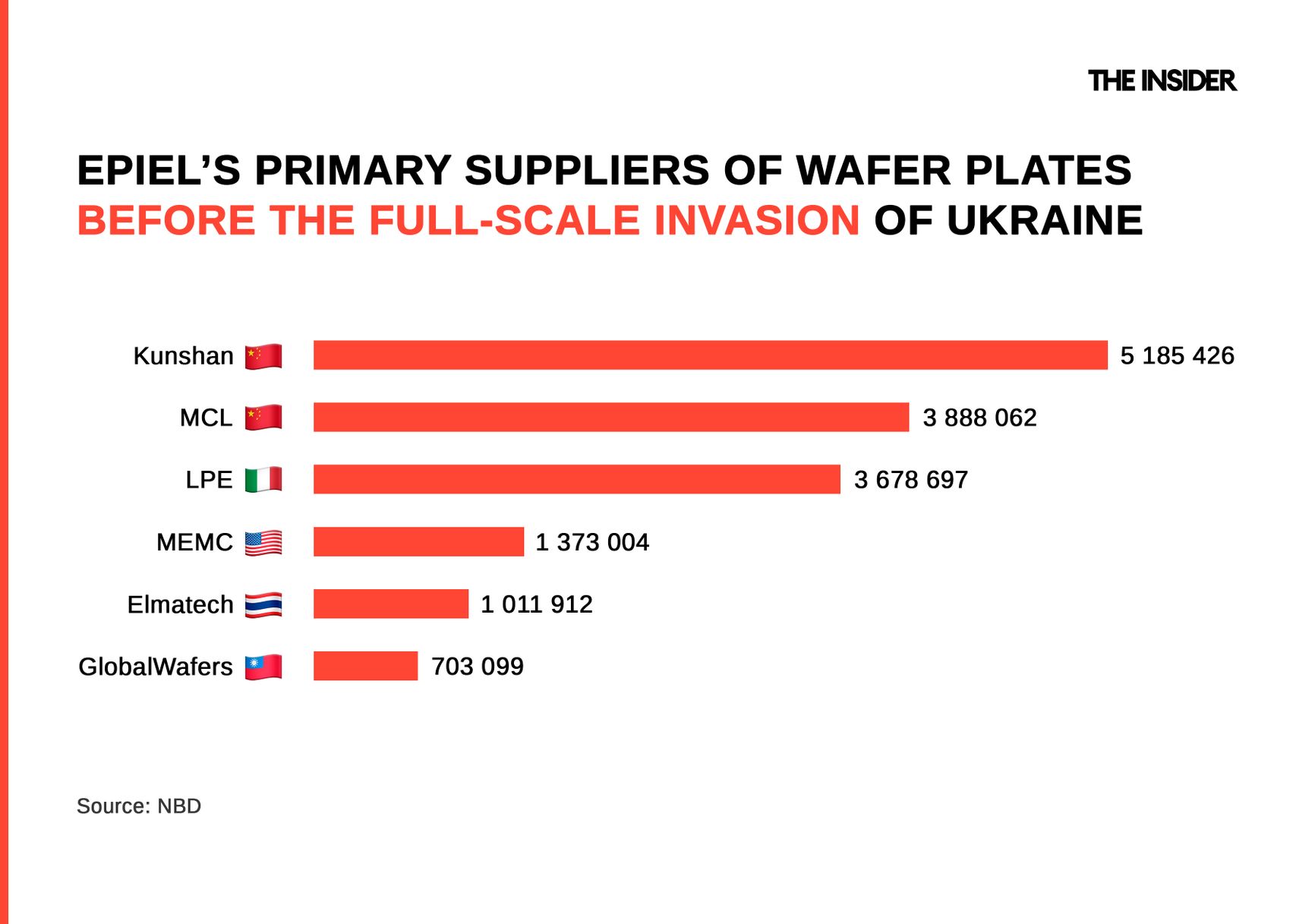

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

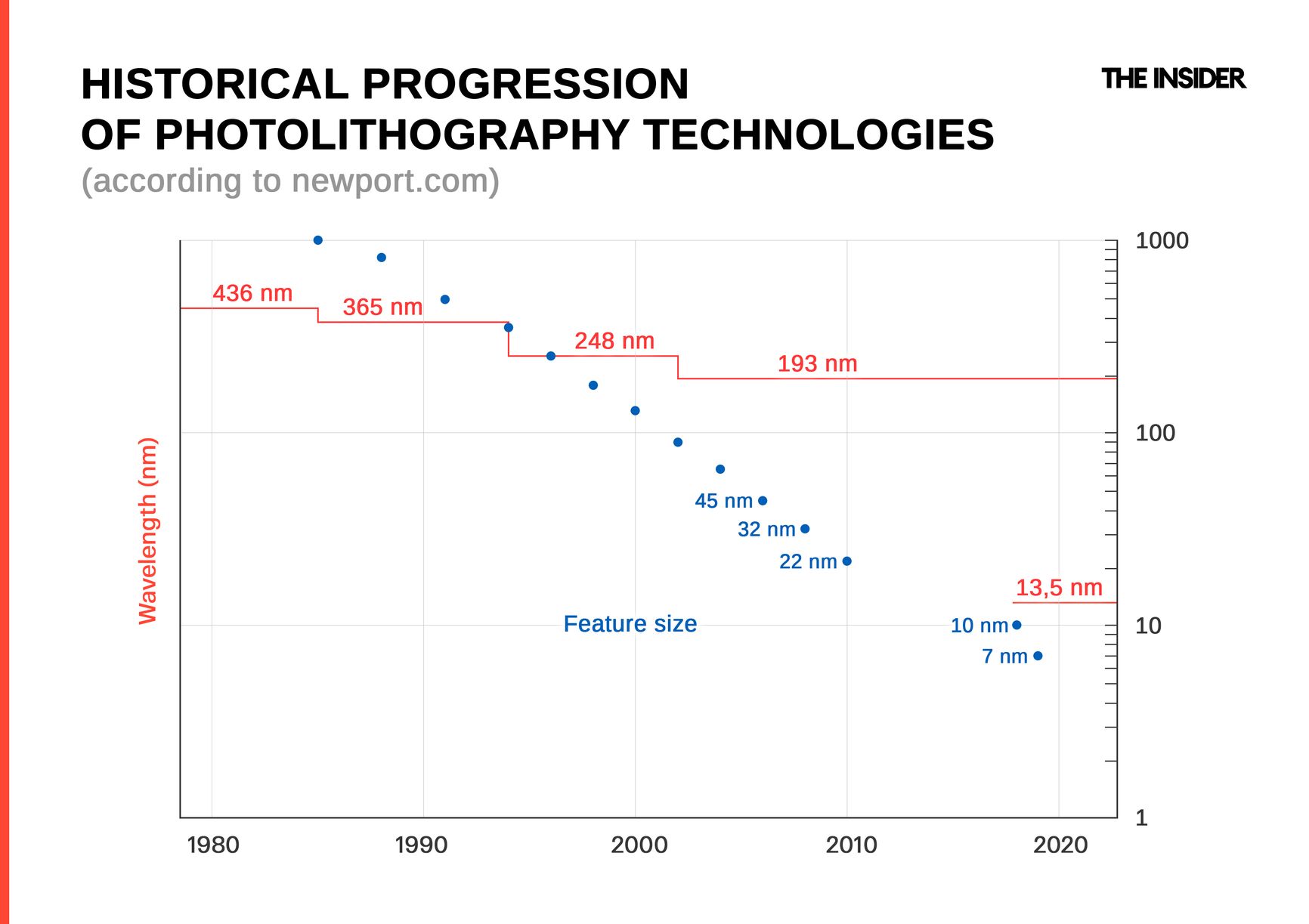

The definitive characteristic of modern photolithography is the wavelength of the machine's laser. The shorter the wavelength, the smaller the feature size (and the higher the resolution). While the 193 nm (“deep ultraviolet”) wavelength tools are made by ASML, Nikon, and Canon, the 13.5 nm (“extreme ultraviolet”, which approaches the X-ray range) is only made by ASML. Samsung may have the capacity to make such tools, but the company probably uses them only for its own needs. And hardly anyone can set up the production of state-of-the-art chip manufacturing equipment from scratch.

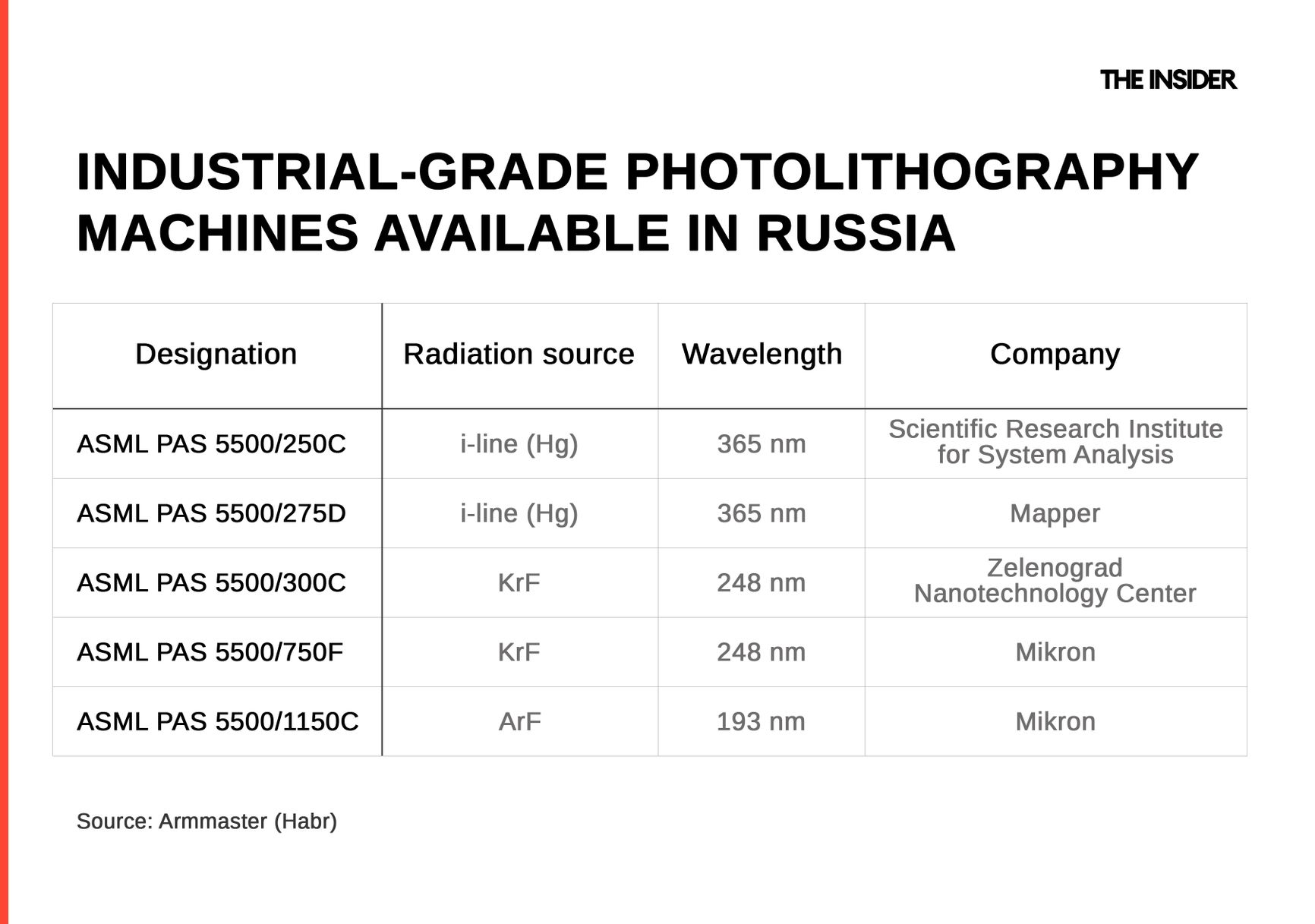

An ASML spokesperson assured The Insider that the company has never sold substantial amounts of equipment to Russia. Since 2014, $50 million worth of ASML-branded goods have been imported into the country. The dollar value may appear significant, but in fact it is not enough to buy even a single modern lithography system, as prices vary from $100 million to $400 million. Russia only imported parts of dismantled old equipment from third countries, ASML asserts. Ukrainian publication Ekonomichna Pravda largely confirms this assessment. As of 2022, five industrial ASML installations with wavelengths ranging from 365 to 193 nm were reported to be in operation in Russia: at the Scientific Research Institute for System Analysis, Mapper, Zelenograd Nanotechnology Center, and Mikron.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

According to the manufacturer, these machines are extremely outdated, 15 to 20 years old. Yet they appear to be functional. In 2023 alone, almost $3.5 million worth of photomasks intended for ASML systems passed through Russian customs. ASML insists that it does not service its equipment and that the parts circulate in a secondary market that the manufacturer does not control.

Internal data from Russian customs suggests that in 2023, Russia imported a total of $150.5 million worth of goods intended for the production of microchips and printed circuit boards (customs code 848620). The list of buyers includes innocuous civilian entities (such as Sitronics Smart Technologies, which manufactures smart cards and chips, and Hevel, which makes solar panels), resellers of various equipment (including sanctioned goods), and organizations that bought small volumes of equipment for a peripheral, non-core project (such as the IT company Crafttech).

However, there are also companies like Epiel, which claims to produce microchips in Russia and is well-connected in the country’s military-industrial complex. Such companies account for the majority of purchases under HS code 848690, which indicates parts and accessories for chip fabrication equipment. Of those firms listed, only Sitronics Smart Technologies, Hevel, and Epiel are known to produce chips independently.

In addition to the handful of Western lithographic machines imported in pre-sanction times, Russian manufacturers have access to machines from the Minsk-based Planar plant. These operate at a wavelength of 350 nm with a minimum feature size of 500 nm, representing a technology that emerged in 1995 and had become obsolete by 1999.

Military production

The lack of modern technologies for the production of high-performance, commercially viable microchips in Russia does not mean that local manufacturers do not know how to lithograph semiconductor crystals. Technologies for doing so were developed back in Soviet times. For example, the Russian company Mikron has mastered the 180-nm technology in mass production and 90-nm in piece production, according to photolithography professional Denis Shamiryan. For the 90 nm process, Mikron uses STMicroelectronics lithography equipment. Mikron's civilian products are limited to chips for bank cards and passports. Its yearly output reaches 4 billion microchips. As Shamiryan recalls, there were also plans to produce chips at Angstrem-T in Zelenograd, Moscow Region, with the use of 130-nm and 90-nm technologies. In the late 2000s, Angstrem-T purchased full ASML production lines from AMD's Fab36 plant in Dresden. However, the plans never came to fruition, as Angstrem-T was declared bankrupt in 2019. However, another Zelenograd-based entity with a similar name, Angstrem (minus the T), produces a range of microchips.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

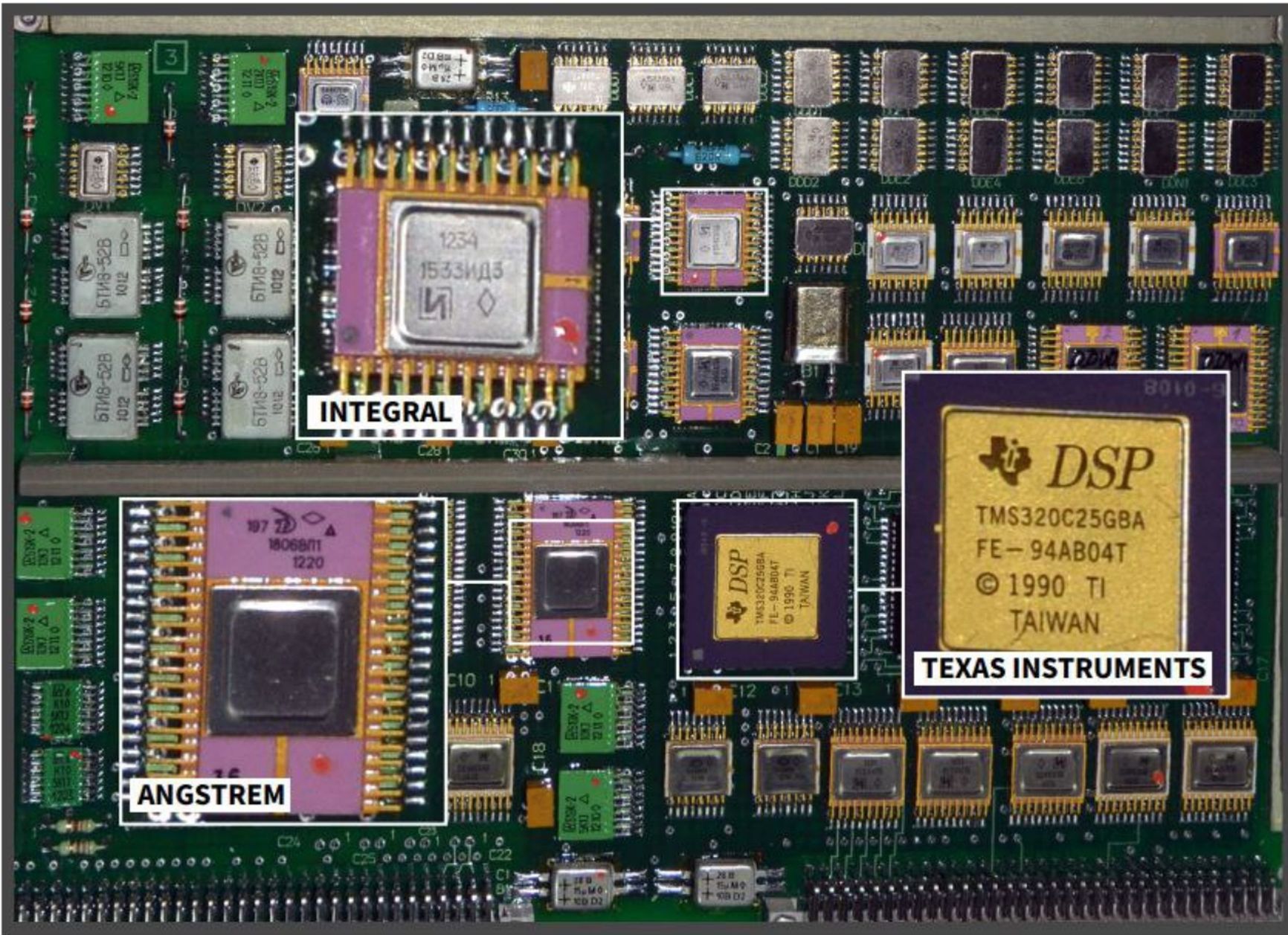

An Angstrem microchip from an Iskander missile on the same board as Western chips

Finally, as Shamiryan writes, Crocus NanoElectronics, a Rusnano Group plant, succeeded in setting up the 65-nm process. The plant was built to produce magnetoresistive RAM (random-access memory). However, it could only carry out half of the production cycle itself and remained dependent on foreign supplies. As a result, sanctions put the plant out of business.

Russia’s surviving microchip production facilities serve mainly military needs. Thus, joint-stock company AO Epiel operates in Zelenograd near Moscow and positions itself as Russia's leader in the epi process. Also known as epitaxial growth, this process, which optimizes the performance of semiconductor devices and integrated circuits, is an essential stage in silicon wafer fabrication. According to its latest public financial statement, the company’s 2020 revenue bordered on $7 million. Epiel works with wafers 100, 150, and 200 mm in diameter. Meanwhile, the most advanced modern technology utilizes 300-mm plates. Epiel secured government contracts from the Ministry of Industry and Trade for hundreds of thousands of dollars and supplied processed wafers to the joint-stock company NZPP Vostok (“Novosibirsk Plant of Semiconductor Devices”), which produced ready-made chips for end manufacturers. According to the latest available public procurement data, NZPP Vostok actively cooperated with a Rosatom entity, the K.A. Volodin Instrument-Making Plant (Federal State Unitary Enterprise), which specializes in the production of nuclear munitions.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

NZPP Vostok actively cooperated with a Rosatom entity that specializes in the production of nuclear munitions

To say that NZPP Vostok's products are obsolete is an understatement. The plant still makes 64-Kbit memory chips and, at least until recently, was selling millions of rubles worth of them to military enterprises such as the Rybinsk-based Luch Design Bureau, which develops military equipment, including drones.

Another customer of Epiel’s is the Voronezh-based Research Institute of Electronic Equipment, which supplies the Fiolent military plant in occupied Crimea, the Sozvezdie Concern (which manufactures electronic warfare and communication and control equipment for the armed forces), and Rosatom's aforementioned Volodin Instrument-Making Plant. Available records also suggest the existence of cooperation between Epiel and the former electronics plant Pulsar, which manufactures microwave devices, transistors, and microchips for the military. Epiel has also fulfilled contracts for the N.L. Dukhov All-Russian Research Institute of Automation, which develops nuclear warheads. Epiel's address matches that of Sitronics Smart Technologies, which is said to belong to the Mikron Group. Moreover, Epiel shares premises with Mikron and the Research Institute of Molecular Electronics. Therefore, it is reasonable to assume that Epiel belongs to the same group of companies.

Specific applications of Russian-made microchips in weapons include the 1890VM6Ya processor and its variants in Baguette flight control computers on fighter jets.

Russian microchips made by Angstrem are used in the Iskander missile, alongside foreign chips, as shown in the photo above.

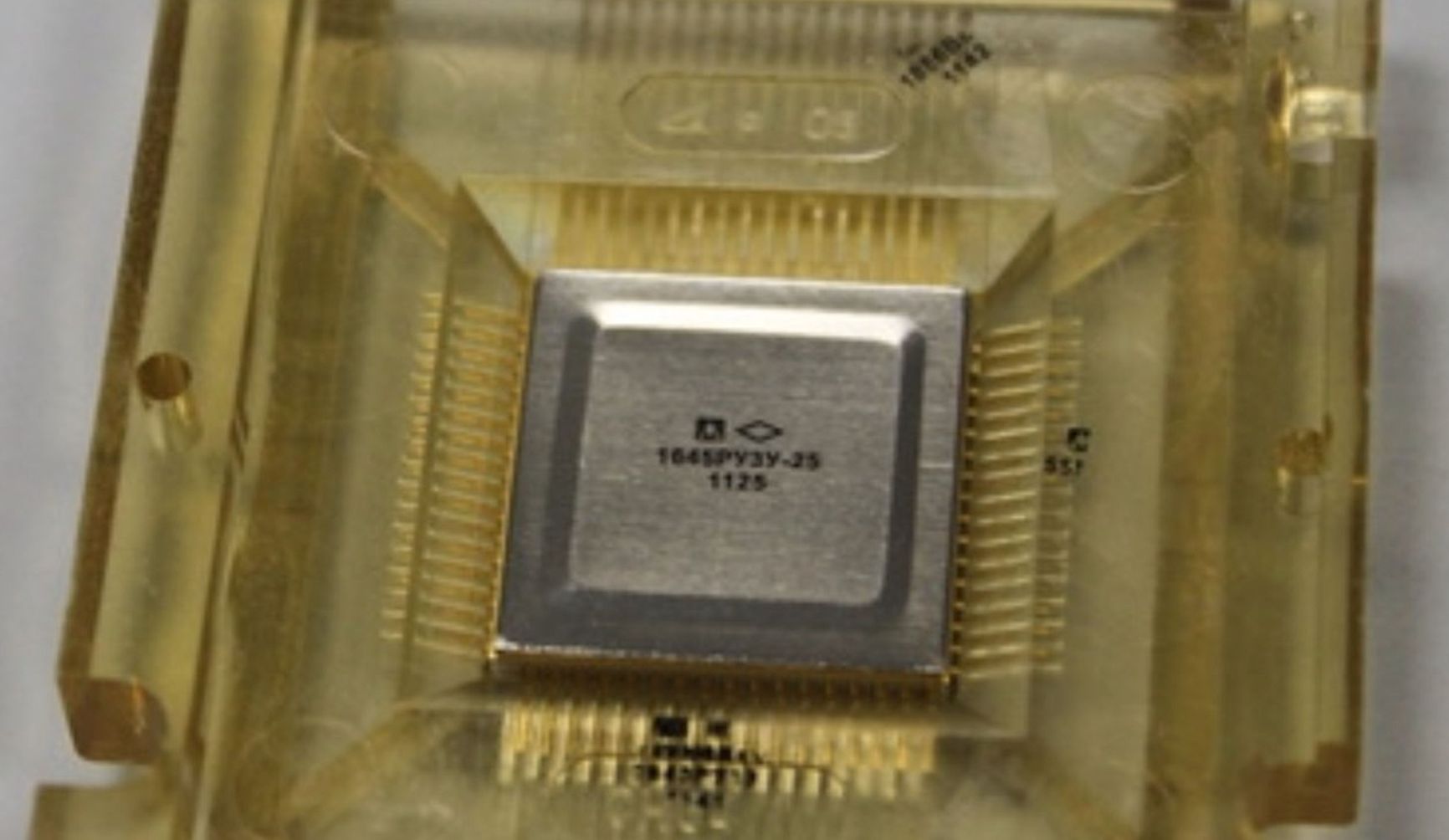

The Russian 1645RU3U memory chip manufactured by Milandr, shown in the photo below, is used in the S-300 and the Pantsir SAM systems.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

A Russian memory chip used in weapons

Back in 2011, an article on the popular IT portal Habr reported that Russian chips manufactured by Milandr on a 180-nm technology machine are used in Russian fighter jets and air defense systems.

The process of Russian domestic chip fabrication seems to work as follows: First, Epiel carries out epitaxial growth on imported wafers. Then companies such as Mikron, NZPP Vostok, Pulsar, or the Research Institute of Electronic Equipment use these semiconductor products to make ready-to-use microchips. According to industry experts, the process may include cutting wafers into individual crystals, attaching pins, and ”packaging” them.

The chips are mostly archaic, but Russian weapons manufacturers must have their reasons for choosing domestic products over more technologically advanced Chinese analogs. Most likely, the Kremlin’s military industry is holding on to the few technologies in which Russia is independent — even if the financial benefits are negligible when compared to Russia’s exorbitant military spending. And since the chips are mostly used in large, heavy weapons, the benefit of miniaturization provided by state-of-the-art electronics is essentially irrelevant.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

The Kremlin’s military industry is holding on to the few technologies in which Russia is independent

Raw materials from Taiwan for “Russia’s very own” microchips

All microelectronic elements are based on silicon wafer plates, or wafers. Semiconductors are deposited on wafers with the use of epitaxy to form microscopic transistors connected by conductor tracks, which are separated by dielectric layers.

Russia’s largest importer of silicon wafers is OOO Hevel, which brought in nearly $7 million worth of wafers from China in 2023, but these are intended for solar panels. What we are looking for is silicon for the military. In that category, one of the largest importers is Epiel, with $2.2 million worth of wafers in 2023. Many of the company’s end users are military enterprises, and the majority of its suppliers from the early 2010s up until the full-scale invasion of Ukraine were Asian and U.S.-based entities.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

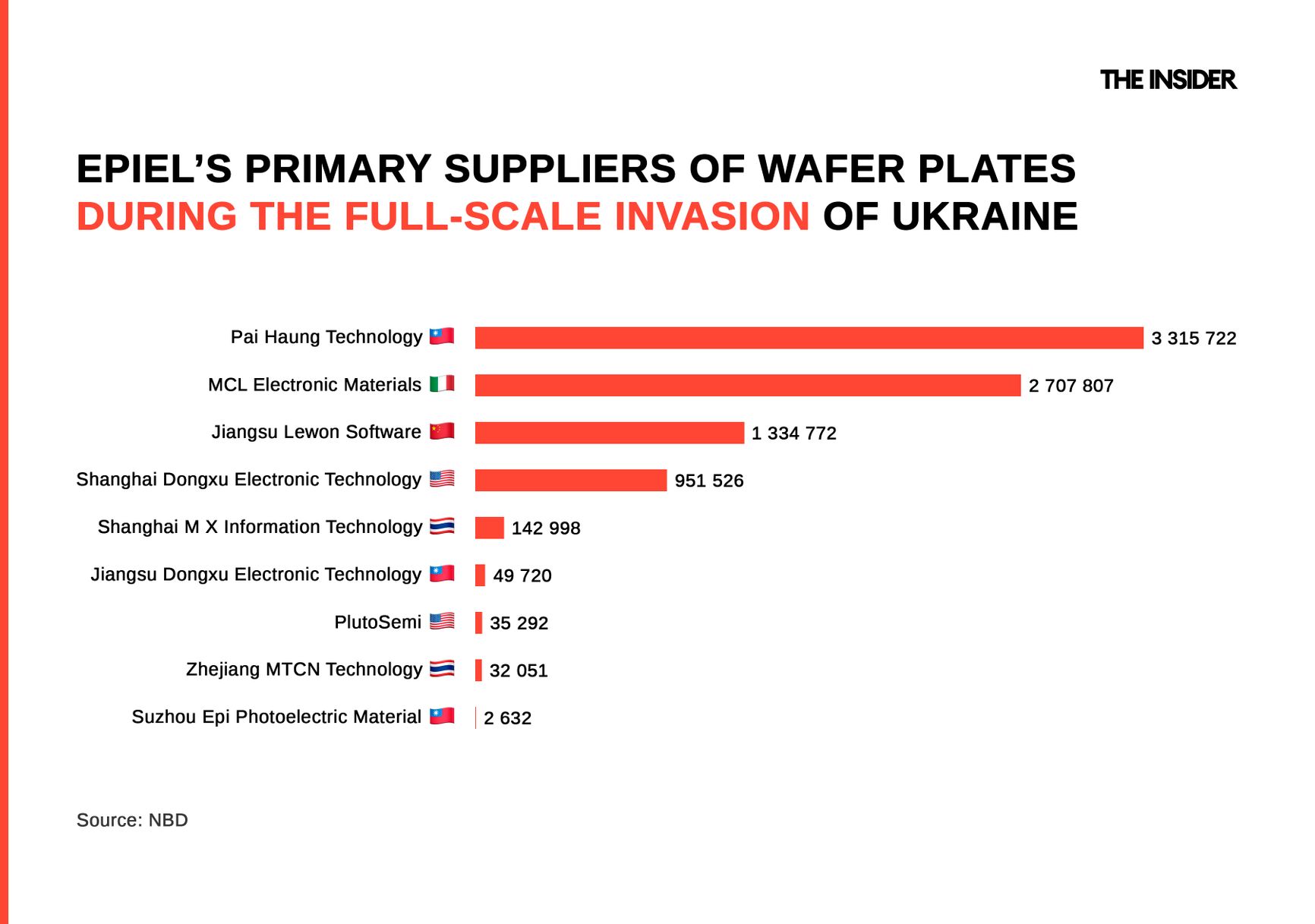

After the outbreak of full-scale war, Epiel had to overhaul its entire supplier base and begin sourcing silicon wafers from several major exporters in Southeast Asia.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.

In this list, Pai Haung Technology stands out for reasons other than sheer volumes. Customs records suggest that this company does business only with a handful of Russian and Belarusian entities, shipping wafers to them directly from Taiwan. Since the full-scale war in Ukraine began, Pai Haung Technology has sold $4 million worth of wafers to Russia and Belarus under its original brand. However, the brand does not have any online presence to speak of, and many customs documents list a different company as the manufacturer — Wafer Works Corporation.

According to its corporate website, Wafer Works has been around since 1997 and is a well-established wafer manufacturer with revenues of about $400 million a year. Its management and production facilities are located in Taiwan.

If the obscure Pai Haung Technology brand does not in fact manufacture wafers, then its role in the chain is limited to that of a reseller-intermediary. Project Kharon investigators discovered that Pai Haung Technology was listed as an affiliated entity on the website of the U.S.-based DMS Electronic Components Group (incidentally founded by Soviet emigres). Now, however, that bit of information has disappeared from the site.

Violation of sanctions

In an interview with Taiwanese journalist Yian Lee, Pai Haung CEO Bao Yongjian said he strictly abides by Taiwanese laws and does not do business with sanctioned companies. Zelenograd-based Epiel is indeed not included in the Taiwanese or other sanctions lists, even though it is an integral link in the manufacturing process for products ultimately used by Russia’s military industry. However, another of Pai Haung's clients, AO VZPP Mikron (joint-stock company Voronezh Plant of Semiconductor Devices Mikron), is under sanctions. In 2020, Mikron received a series of government contracts to develop radiation-hardened Zener diodes of up to 1,200 volts, which are more likely to find military rather than civilian applications.

UPD After this article was published, Pai Haung Technology contacted The Insider and provided an extra comment, stating that they supply only “test” (or “monitoring”) wafers to EPIEL. Pai Haung Technology claims to have “worldwide business,” the business with Russia being a smaller part of it. The company states that the Project Kharon reporting is incorrect. Pai Haung Technology also claims that they ceased any business with Mikron and Kremny after those companies were put on the US sanctions list in 2022 and also ceased the business with AO VZPP Mikron after it was placed on Taiwan’s sanctions list in May 2022.

Epiel's fourth largest supplier is the Chinese arm of Japanese corporation D&X Co. Ltd. In response to The Insider's request, the Japanese Ministry of Economy, Industry, and Trade sent a list of banned goods, which shows that the export of silicon wafers (code 381800) to Russia by Japanese companies is not allowed. D&X Co has not responded to The Insider's inquiry. The ministry also stated it had been unaware of D&X Co's shipments to Russia.

AO VZPP Mikron belongs to the group of entities affiliated with the Mikron plant in Zelenograd. The group also includes AO Mikron, OOO Mikron Security Printing, OOO Sitronics Smart Technologies, OOO Element Technologies, and a few dozen more companies. It is impossible to establish the comprehensive structure of ownership for this conglomerate based on open-source tax data, as relevant ownership data for legal entities set up as AO (joint-stock companies) is not available in the public domain. Wikipedia lists OAO RTI as Mikron’s parent organization. In April 2024, it was merged with AO Research and Production Association of Long-Range Radiolocation (Previously known as the RTI Systems Concern). As follows from Wikipedia and the Association of Russian Banks, the majority shareholder of the latter company is AFK Sistema, a conglomerate owned primarily by Vladimir Yevtushenkov, a Russian oligarch who appears on multiple sanctions lists.

- Pai Haung Technology (Taiwan)

- MCL Electronic Materials (China)

- Jiangsu Lewon Software Co., Ltd. (China)

- Shanghai Dongxu Electronic Technology (the Chinese arm of the Japanese corporation D&X Co., Ltd.)

- Kunshan Sino Silicon Technology Co., Ltd. (China, up to 2018)

- MCL Electronic Materials, Ltd. (China)

- MEMC Electronics Materials (USA, up to 2018)

- Elmatech Co., Ltd. (Thailand, up to 2018)

- Globalwafers Co., Ltd. (Taiwan, up to 2019)

To name a few, SMT-Max, Sovtest ATE, Sunrise, and Contract Holding.

Filters used to expose photoresist in certain areas of the wafer.

Microchip manufacturing in a nutshell:

- Photolithography equipment installation

- Integrated circuit design

- Fabrication of photomasks based on the design

- Patterning on wafers with the use of photolithography

- Cutting the semiconductor plate into individual circuits, attaching pins, and packaging.