Photo: Exilenova+

Photo: Exilenova+

Since June of this year, Ukrainian forces have mounted an almost continuous series of strikes on Russia’s fuel and energy infrastructure, targeting oil refineries, gas processing plants, and petrochemical facilities. Unlike earlier campaigns, the latest wave has seen not only an increase in frequency, but also greater range and effectiveness — and support from U.S. intelligence appears to be playing a significant role in the success of the “deep strikes.” If attacks continue at their current pace, Russia could face not just temporary, localized fuel disruptions, but systemic shortages and a broader refinery crisis by 2026.

The ongoing strike campaign

Ukraine’s deep strike strategy

A brewing fuel crisis

What continued strikes on Russian refineries could mean

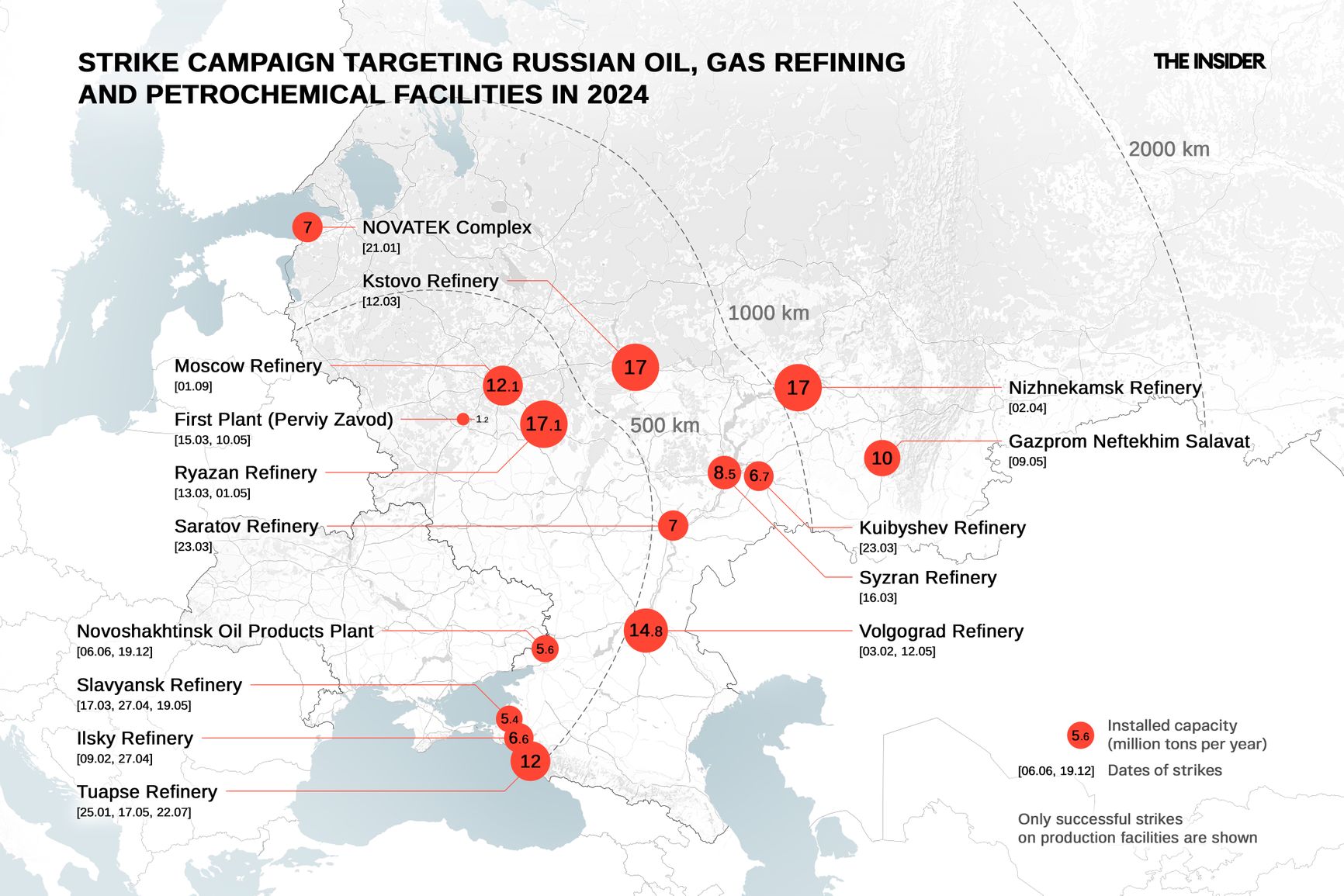

In 2024, Ukraine began a limited strike campaign against oil and gas infrastructure objects inside Russia. That year, 24 attacks were documented targeting 15 enterprises — nearly half of them located within 500 kilometers of Ukraine’s borders.

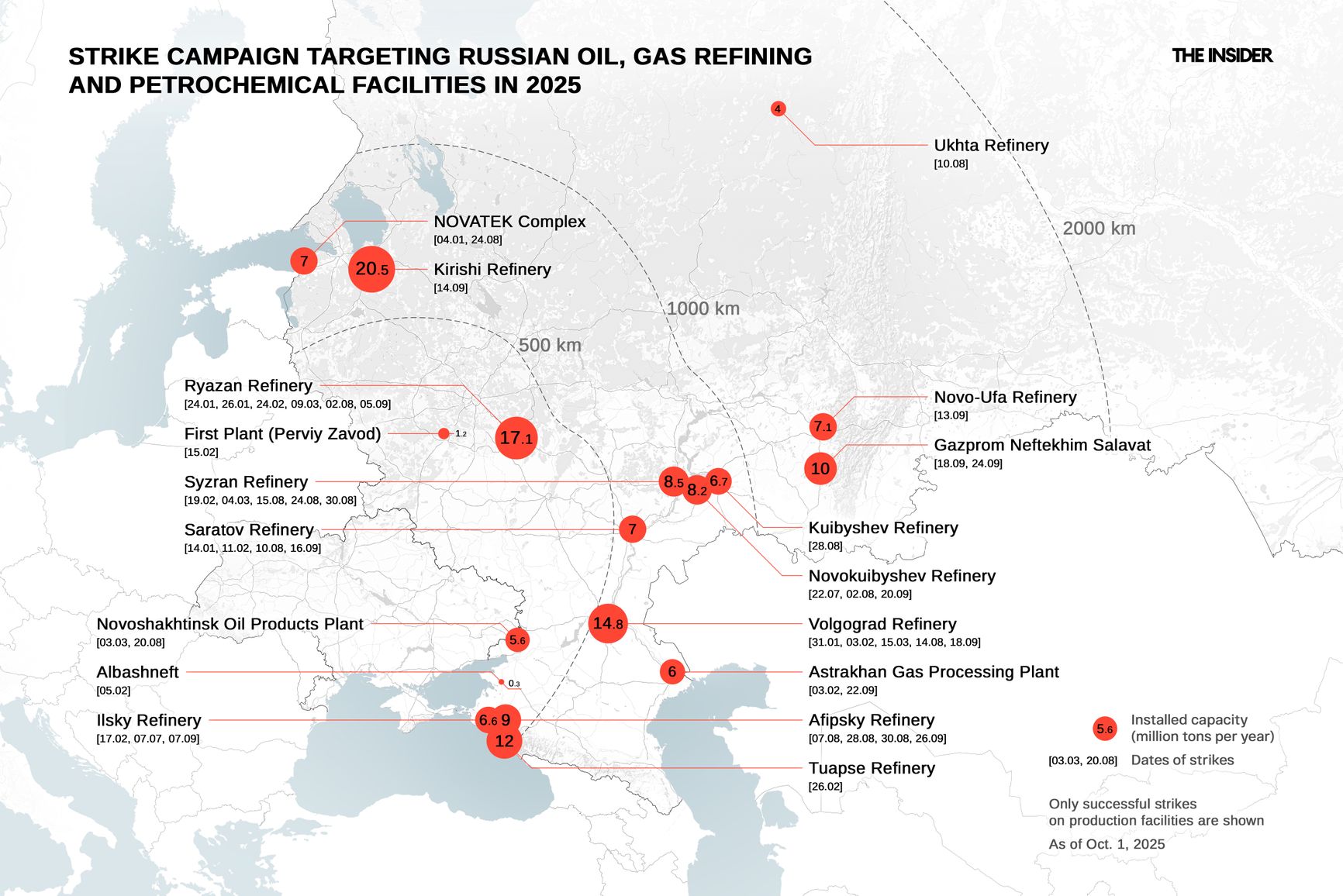

2025 has seen a dramatic increase. In the three months from January through March, there were at least 18 successful attacks on 11 oil, gas processing, and petrochemical enterprises in Russia. Then, after Ukraine paused its campaign from April through June in order to comply with a U.S.-brokered moratorium on strikes targeting refineries, oil and gas depots, pipelines, power grids, power plants, nuclear facilities, and hydroelectric dams, the renewed effort saw 27 such facilities hit between July and October. Most of the 2025 targets were located more than 500 kilometers from Ukraine’s border.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

In the 2025 wave, eight facilities were struck repeatedly, including Russia’s Afipsky, Novokuybyshevsky and Syzran refineries, where the gaps between attacks have shrunk from months to mere weeks. This tactic effectively negates repair efforts and keeps plants idle for long periods of time. At Syzran, for example, a February 18 strike damaged the ELOU-AVT-6 unit. Repairs were nearly complete by March 4 — when another drone hit the same facility.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

Visual evidence suggests Ukraine is widely deploying Firepoint FP-1 drones, which carry warheads of up to 120 kilograms and can reach targets 1,500 kilometers away. Analysts estimate these drones account for about 60% of long-range strikes inside Russia. Their key advantage over the “Lyutyi” and other models is their relatively low cost (coming in at about $55,000 per unit) and scalable production. Targeting accuracy has also improved dramatically, with most successful hits landing on atmospheric-vacuum distillation units and loading racks.

After Ukraine’s failed counteroffensive in summer 2023 and the ensuing Russian advance later that year, Kyiv’s military and political leadership crafted a strategy aimed at increasing the cost of war for Moscow while largely remaining on the defensive along the war’s front lines. The strategy focuses on long-range precision strikes against Russia’s defense industry, energy sector, airfields, and ammunition depots.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

Ukraine’s “deep strike” strategy is aimed at increasing the cost of war for Moscow.

Oil and gas infrastructure — including refineries, pipelines, storage sites, and export terminals — are central to this plan. Since the invasion began, energy exports have brought Russia more than €850 billion, several times the total value of military, humanitarian, and financial aid provided to Ukraine by its allies.

The issue is a point of contention for global energy markets, which is why both the Biden and the Trump administrations at times urged Kyiv to refrain from striking Russian oil and gas assets. However, since mid-2025, that restraint appears to have ended. According to media reports, Ukraine’s current refinery strike campaign has benefited from U.S. intelligence sharing and route planning for long-range attacks, a development that has significantly boosted both its precision and its depth.

The strikes coincided with seasonal demand peaks and scheduled maintenance at several Russian plants, triggering a severe gasoline shortage across the country. Fuel supply disruptions have hit nearly 60 Russian regions, with annexed Crimea facing the worst shortages. Authorities there have imposed a 20-liter-per-person cap, prompting panic buying, long queues, and even fuel theft. Local officials have moved to freeze prices for 30 days.

Wholesale gasoline prices have hit record highs, and retail prices have risen by 0.3% to 0.4% per week since June — outpacing inflation.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

Wholesale gasoline prices in Russia have hit record highs, and retail prices have risen by 0.3% to 0.4% per week, outpacing inflation.

Deputy Prime Minister Alexander Novak insisted that “the situation is fully under control,” saying supply and demand remain balanced nationwide and that regional shortages are being addressed. The government has banned gasoline exports through the end of the year. Diesel exports, however, remain partially allowed, as production is still double domestic demand.

Gazprom Neft has postponed scheduled repairs at its Omsk refinery due to the fuel crisis, and the Ministry of Energy has asked all oil companies to do the same. “Together with them, we have adjusted the refinery's scheduled repair program so that scheduled repairs do not coincide with the period of peak demand for gasoline. We are also working with Russian Railways to ensure that tankers with gasoline from production regions are quickly transported to regions with the highest demand for gasoline,” Energy Minister Sergei Tsivilev explained.

Novak also proposed that Prime Minister Mikhail Mishustin temporarily lift the ban on the gasoline additive monomethylaniline (MMA) for six months. “Despite the measures taken to protect fuel and energy facilities, there are risks of a deterioration in the situation with the supply of petroleum products to the domestic market,” Novak warned.

Russia typically produces more fuel than it consumes domestically, exporting roughly half — mainly diesel and fuel oil. Nationwide production should, in theory, cover demand, but the problem is delivering it on time.

Estimates of the damage to refining capacity vary widely. As of late September, roughly 38% of Russia’s primary refining capacity — about 338,000 tons per day — was offline, according to calculations by the agency Siala, with 70% of the outages linked to Ukrainian drone attacks. Some experts, however, doubt this unusually high figure. Sergey Vakulenko of the Carnegie Russia Eurasia Center in Berlin said the number likely reflects the combined capacity of all refineries hit since Aug. 1, 2025 — not those simultaneously out of operation. “Is that the right way to count it? For getting an upper-bound estimate, yes,” he said.

In other words, if every strike were successful, and if the resulting damage completely knocked the refineries out of operation, the losses would amount to no more than 38% of Russia’s total refining capacity, Vakulenko explained. “To arrive at a more realistic figure, you need to answer at least two questions and adjust accordingly: first, can we really assume that every strike disables an entire plant to the point that it completely stops production, removing all of its capacity from the available volume? Second, is it certain that none of the damage has been repaired in the meantime — that the affected refineries are still offline?” Vakulenko said that in most cases, the refineries were only partially damaged, and some have already been repaired, meaning that part of the lost capacity has likely been restored.

A more realistic estimate comes from JPMorgan Chase, which says Russian refinery output has fallen by around 500,000 barrels — a drop of roughly 10%. According to calculations by Reuters, refining capacity has declined by 17%, or 1.1 million barrels per day. While these figures may sound less catastrophic than 38%, the trend is what matters: strikes on refineries continue to disable capacity faster than repairs can be made, meaning the percentage is likely to rise.

The impact of these refinery attacks will be felt both inside Russia and abroad. Mongolia, for instance, may start importing gasoline from China. Independent gas stations not affiliated with major oil producers are already losing money, with some already opting to close, according to reports by the Russian Fuel Union. Delivery delays now stretch up to two months, and the government’s ban on fuel exports has done little to ease the shortages.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

The impact of these oil refinery attacks will be felt both inside Russia and abroad.

According to the union, all this “threatens independent owners, who account for about 60% of the total number of gas stations in the country.” If the reduction in refining is indeed serious and long-term, and if Russian oil companies are unable to sell the released volumes of crude oil, they will be forced to cut production. This, in turn, could reduce federal budget revenues and create financial problems for the Kremlin.

While Russia’s oil refining output fell only 3% in 2024 — to 267 million metric tons — a far sharper decline is expected in 2025. Between August and September, at least 10 major refineries either fully or partially halted operations. Independent analyst George Voloshin told The Insider that if Ukraine maintains its current tempo of strikes, temporary shutdowns could evolve into systemic capacity losses.

Sanctions have cut Russian refineries off from Western technology, and as a result, replacing or repairing damaged components takes significantly longer and often requires the “cannibalization” of already-installed equipment. Russia also lacks sufficient air defense systems to protect all of its critical infrastructure, leaving many facilities vulnerable to repeat strikes. These factors create a “cumulative effect” in which mounting damage lengthens repair times and forces operators to adopt temporary fixes that reduce fuel quality.

Voloshin estimates that over the next six to 12 months refinery shutdowns could reach 25% of total installed capacity. After that, the forecast for Russia is even more grim, as difficulties replacing AVT units (atmospheric-vacuum distillation systems), will likely stabilize refining output at levels well below prewar volumes and could lead to a surge in low-quality fuel and rationing of higher-grade products through administrative allocation. Experts at the International Energy Agency share a more optimistic view, predicting a recovery in refining volumes after June 2026 — though their forecast appears not to account for further Ukrainian attacks.

Still, even significant and long-term damage to Russia’s refining sector would only affect the Kremlin’s ability to finance the war if it leads to a reduction in crude exports — either through Ukrainian strikes on oil transport infrastructure such as pumping stations, pipelines, and export terminals, or through tighter international sanctions on the sale of Russian oil. Recent moves by the Trump administration and European authorities, including sanctions targeting Russia’s largest oil companies and Chinese buyers of Russian crude, make such a scenario seem increasingly plausible.

A specific unit at oil refineries used for the primary processing, or crude oil distillation, and desalting of crude oil.

К сожалению, браузер, которым вы пользуйтесь, устарел и не позволяет корректно отображать сайт. Пожалуйста, установите любой из современных браузеров, например:

Google Chrome Firefox Safari