Despite its publicly pro-Ukrainian position, Taiwan has become Russia’s most important supplier of high-precision metalworking machines, The Insider has discovered as part of a joint investigation carried out with Taiwanese outlet The Reporter. Following the start of Russia’s full-scale invasion of Ukraine, German, Japanese, and Swiss machine tools manufacturers all left the Russian market, and Chinese substitutes proved to be of inferior quality. However, Taiwanese machining centers, lathes, and electrical discharge machines have since filled the gap, satisfying the needs of the Russian military-industrial complex. The Taiwanese technology has proven indispensable in the production of fuses, precision weapons, and other Russian military hardware. Sanctions imposed by the Taiwanese government have not remedied this situation, as the machine tools themselves are shipped to Russia via third countries, including Turkey. And in some cases, critical machinery is not subject to restrictions at all.

Content

Transiting via Turkey

The Transit Network of “I Machine”

Russian company Kometa pays an unusually high price for Taiwanese machines

Taiwanese-made electrical discharge machine units flow into sanctioned institutes

What can be done to end the export of Taiwanese machine tools to Russia

Almost immediately after Russian missiles started striking Ukraine in the early morning hours of February 24, 2022, an international coalition comprising most of the world’s leading technological superpowers announced a raft of economic sanctions targeted against the Kremlin’s war machine. While the measures did not not prove to be capable of convincing Vladimir Putin to call off his war — let alone to bring Russia’s resource-based, increasingly militarized economy crashing down — they have made it more difficult and more expensive for Moscow’s military-industrial complex to procure and produce the armaments that have continued to fall on Ukrainian soldiers and civilians every day since Russian tanks and troops first openly crossed the border.

One of the most important cogs in that Russian war machine is machine tools themselves — including machining centers, lathes, and electric discharge machines — which are used in the production of almost every weapon in the Russian arsenal. Most of the machines used in the manufacture of high-precision military equipment are produced by companies in the European Union, Switzerland, Japan, and North America, all of which have joined the international sanctions regime against Russia. Russian attempts to fill the gap with Made in China substitutes have not yielded acceptable results — at least from Moscow’s point of view.

However, there is one additional economy capable of producing the types of machines that the Russian military-industrial complex craves: Taiwan, which is a leading exporter of high-precision cutting electric discharge machines, cylindrical and profile grinding machines, thread grinding and gear grinding machines, longitudinal turning machines, and vertical turning machining centers. While the quality of Taiwanese machines still lags behind that of its Western competitors, it still represents an improvement when compared with the options on offer from China.

“The accuracy and productivity of turning and milling machines from China or Taiwan are similar,” Dr. Mykola Skrypnyk, an engineering PhD and the CEO of Abplanalp Ukraine, told The Insider. “However, in what concerns electric discharge and grinding machines, the quality, functionality and performance of the Taiwanese machines is higher compared to those of the Chinese ones.”

That difference in quality is critical in the production of modern weaponry. Again according to Skrypnyk: “High accuracy is needed in the production of fuses, of high-precision weapons’ control systems, of high-quality optics, in the production of electronics and engines, for milling and grinding mono-wheels or blades of turbine engines, when machining combustion chambers, while producing gearboxes, while polishing cogwheels, when grinding aircraft chassis, crankshafts, in the manufacture of hydraulic pumps, hydraulic distributors, etc.”

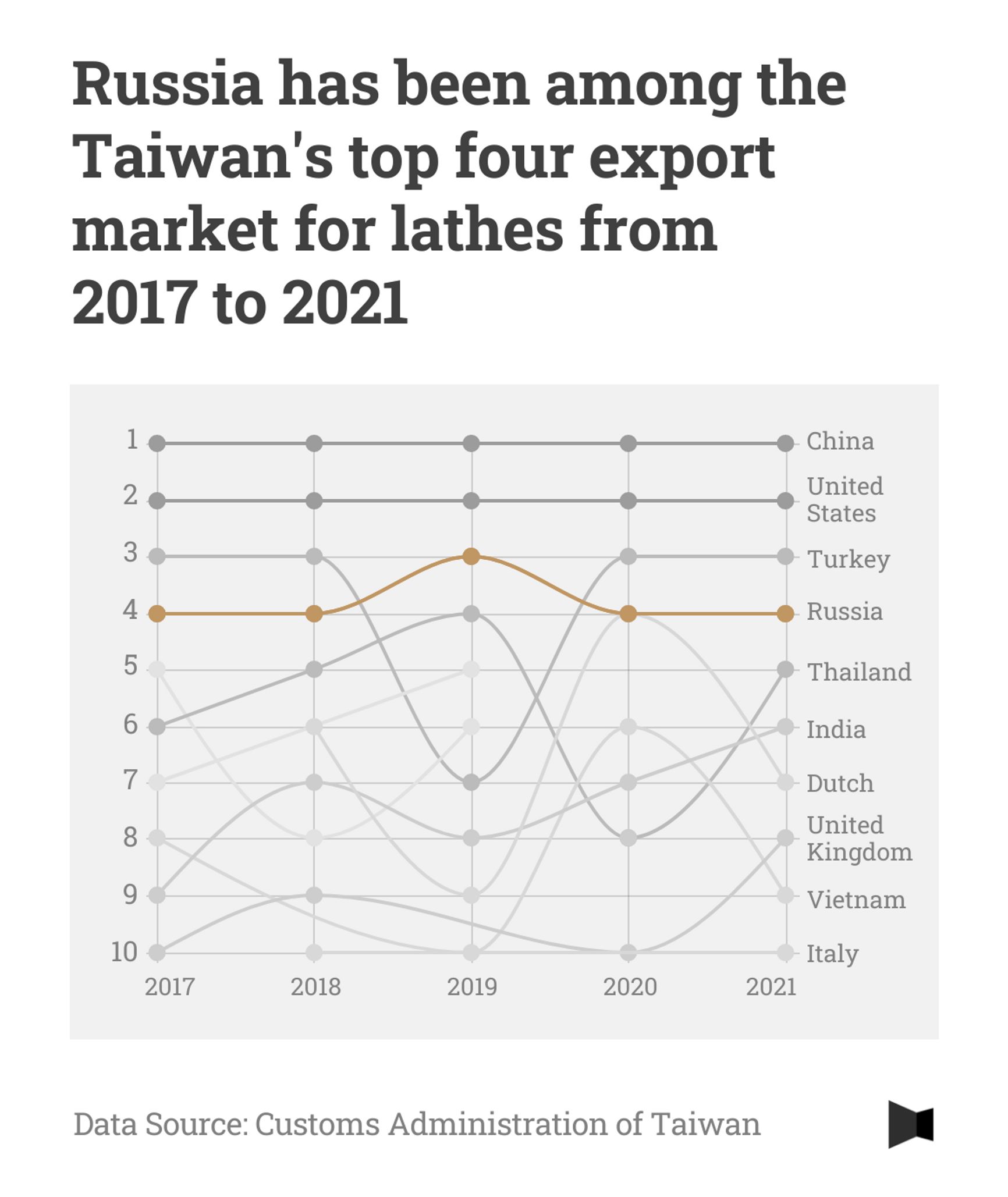

The relationship between Taiwanese machine tools makers and Russian customers is not new. Taking lathes as an example, Russia had been one of Taiwan's top four export markets since 2017, with average annual sales exceeding $30 million.

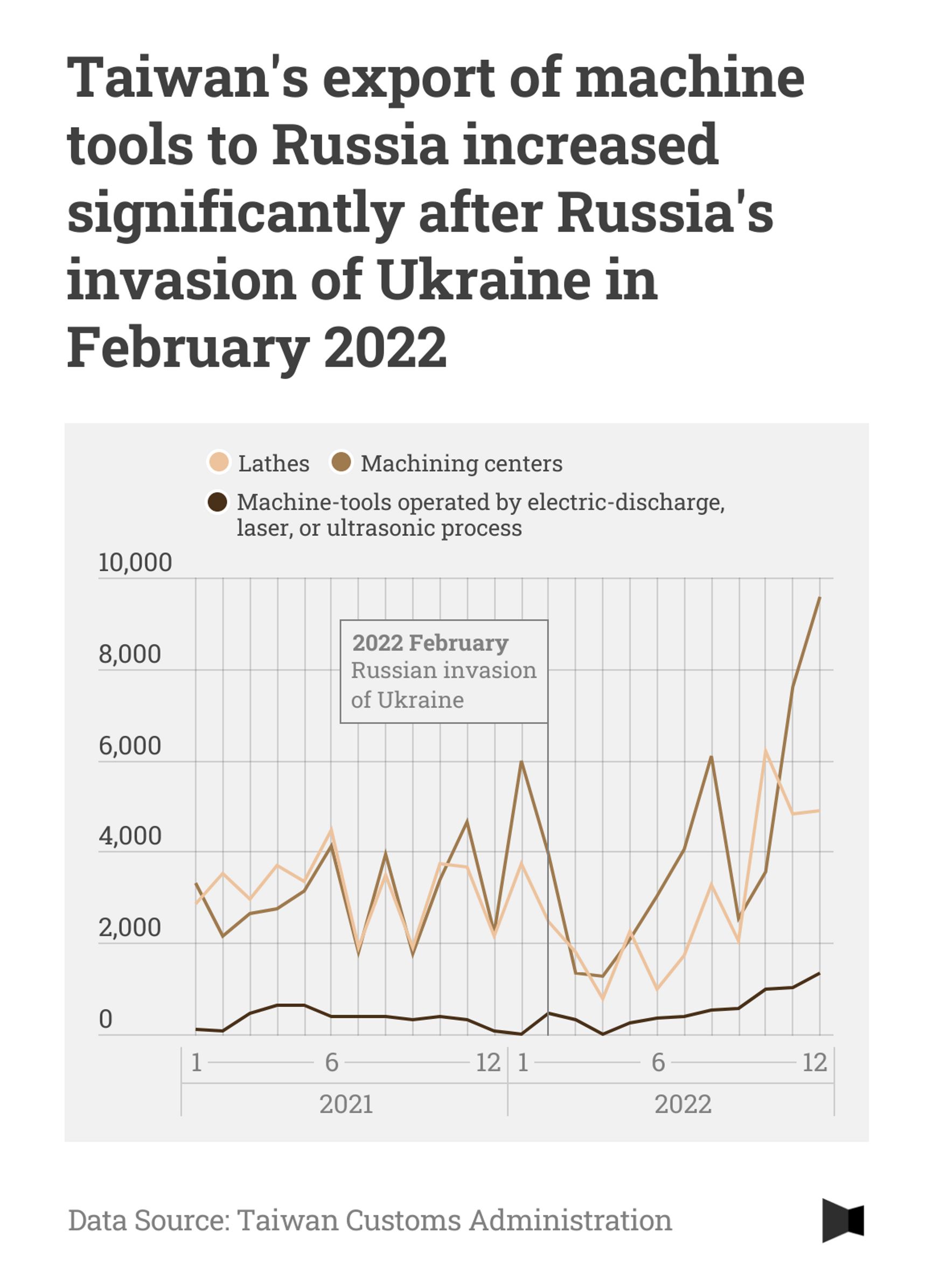

After the start of Russia’s full-scale invasion of Ukraine, Taiwan, like much of the rest of the civilized world, announced sanctions against the aggressor. However, the first wave of sanctions only covered goods in the fields of semiconductors, telecommunications, and aerospace. They did not include machine tools. With its access to other markets closed off, Russia shifted its demand for high-end machine tools to Taiwan.

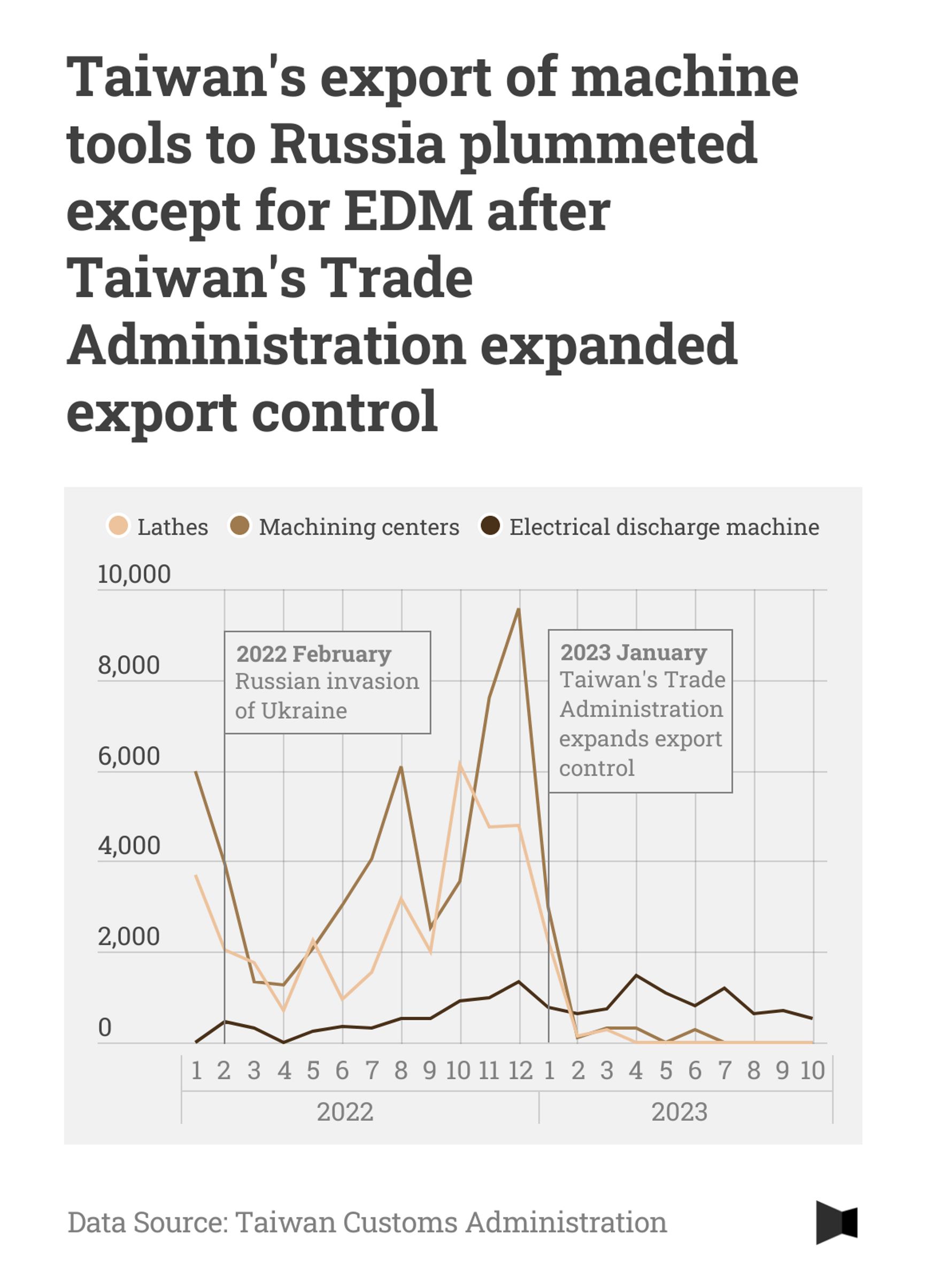

In January 2023, Taiwan’s Ministry of Economic Affairs finally took action, expanding the sanctions list to include the kinds of high-end machine tools Russia had legally been buying up for nearly a full year after the start of its unprovoked invasion. Following this policy switch, Taiwan's direct exports to Russia of complex machining machines and high-end lathes dropped almost to zero, leaving only loosely controlled electrical discharge machines available for purchase by Russian customers. But the story does not end there.

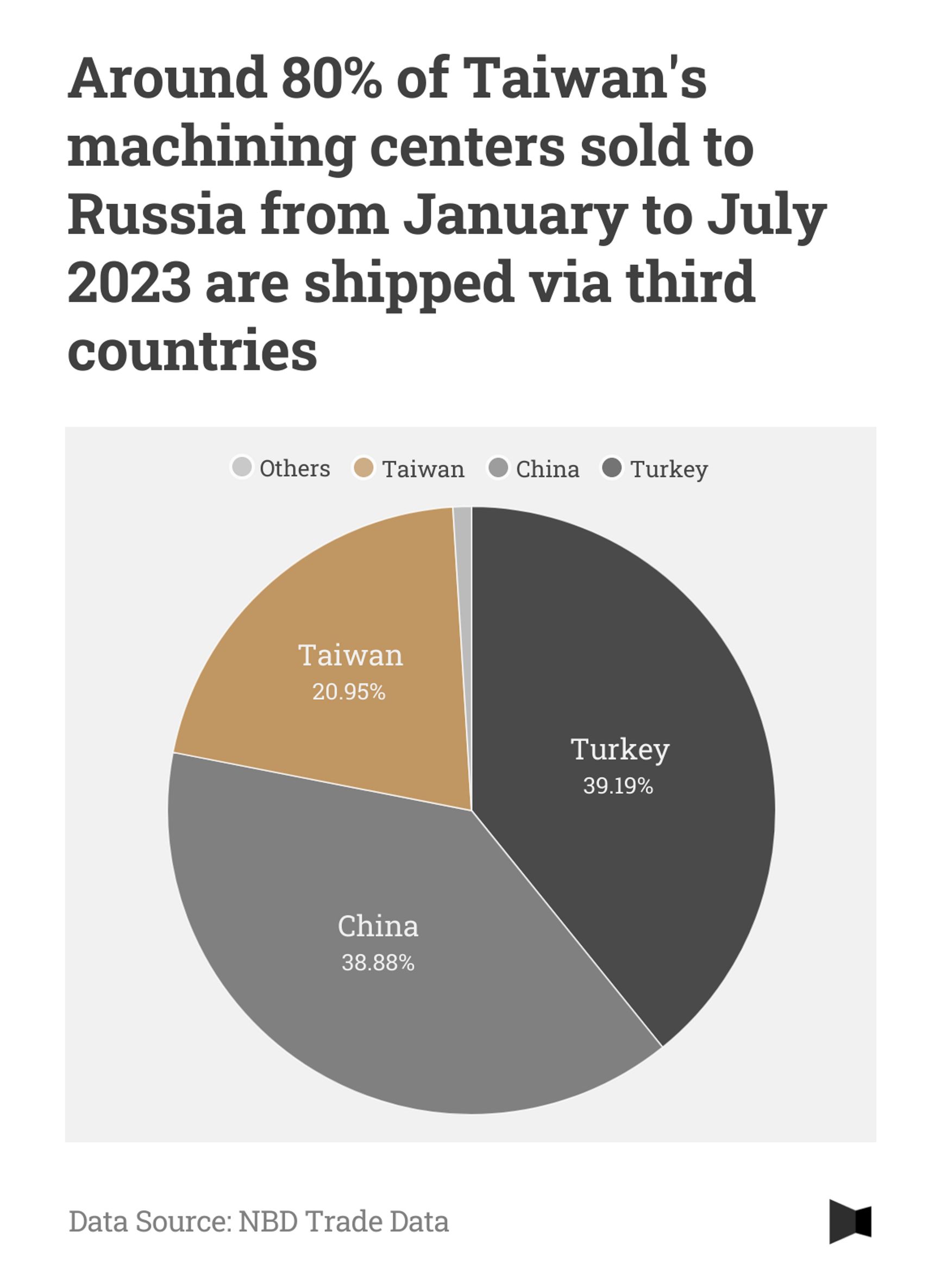

Transiting via Turkey

According to Russian customs records from NBD (a platform specializing in international trade data collection), between March and September 2023, Russia imported at least 193 Taiwanese-made machining centers worth a total value of nearly $29 million. Close to 80% of the Taiwanese comprehensive processing machines flowing into Russia are transshipped through third countries, with Turkey and China being the top culprits.

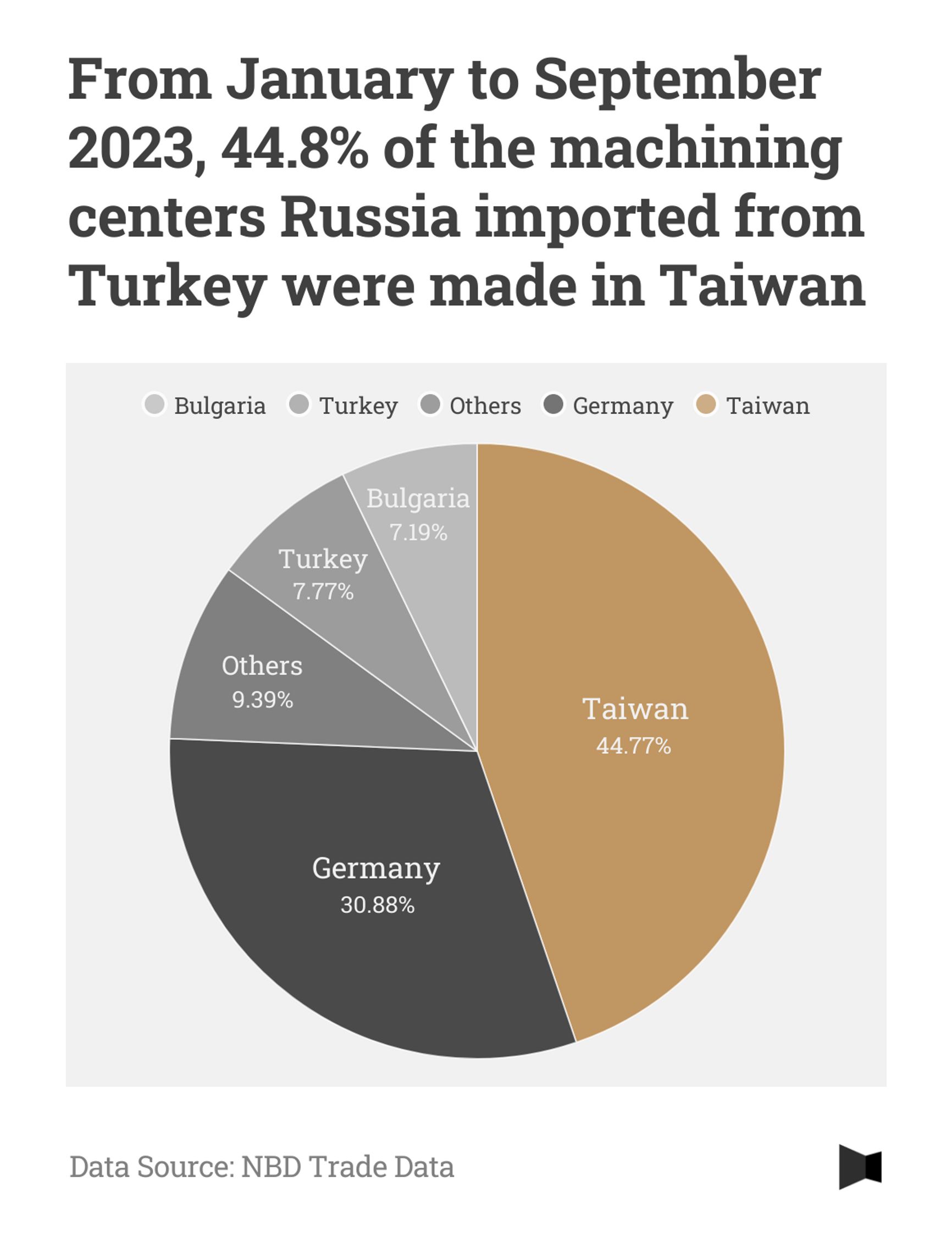

While Taiwanese machines are not the only ones being illegally transshipped to Russia, a look at Turkish transit point data shows that, as of September 2023, they comprised a large plurality of Russian imports being moved along that particular route.

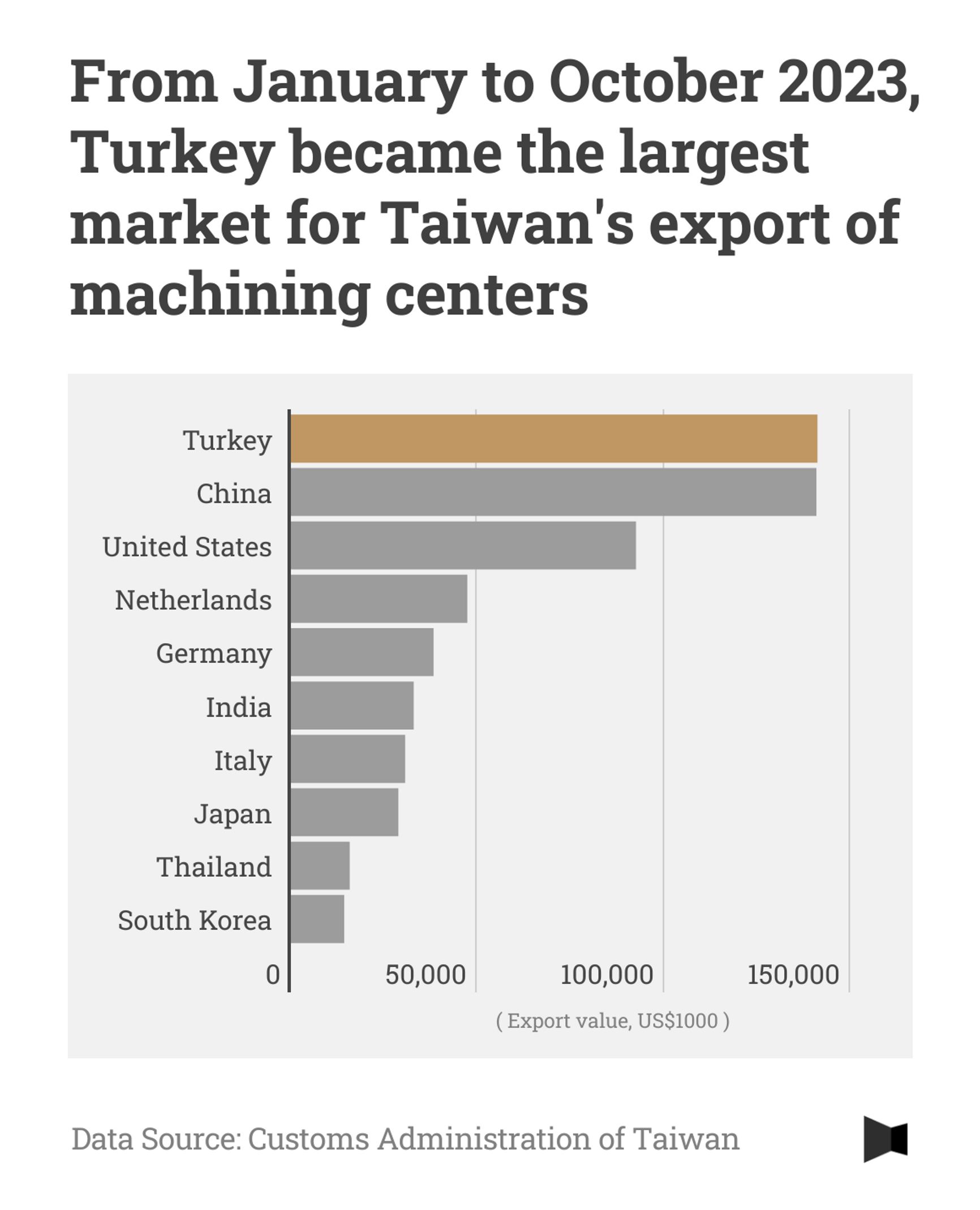

Taiwanese customs statistics also reflect the fact that Turkey has been serving as a transit point for the island’s exported machine tools. The total value of Taiwan's machining exports to Turkey between January and October 2023 showed a 45% increase over that of the same period in 2022. This jump suddenly made Turkey the leading export market for Taiwan’s machine tools makers — officially at least.

The Transit Network of “I Machine”

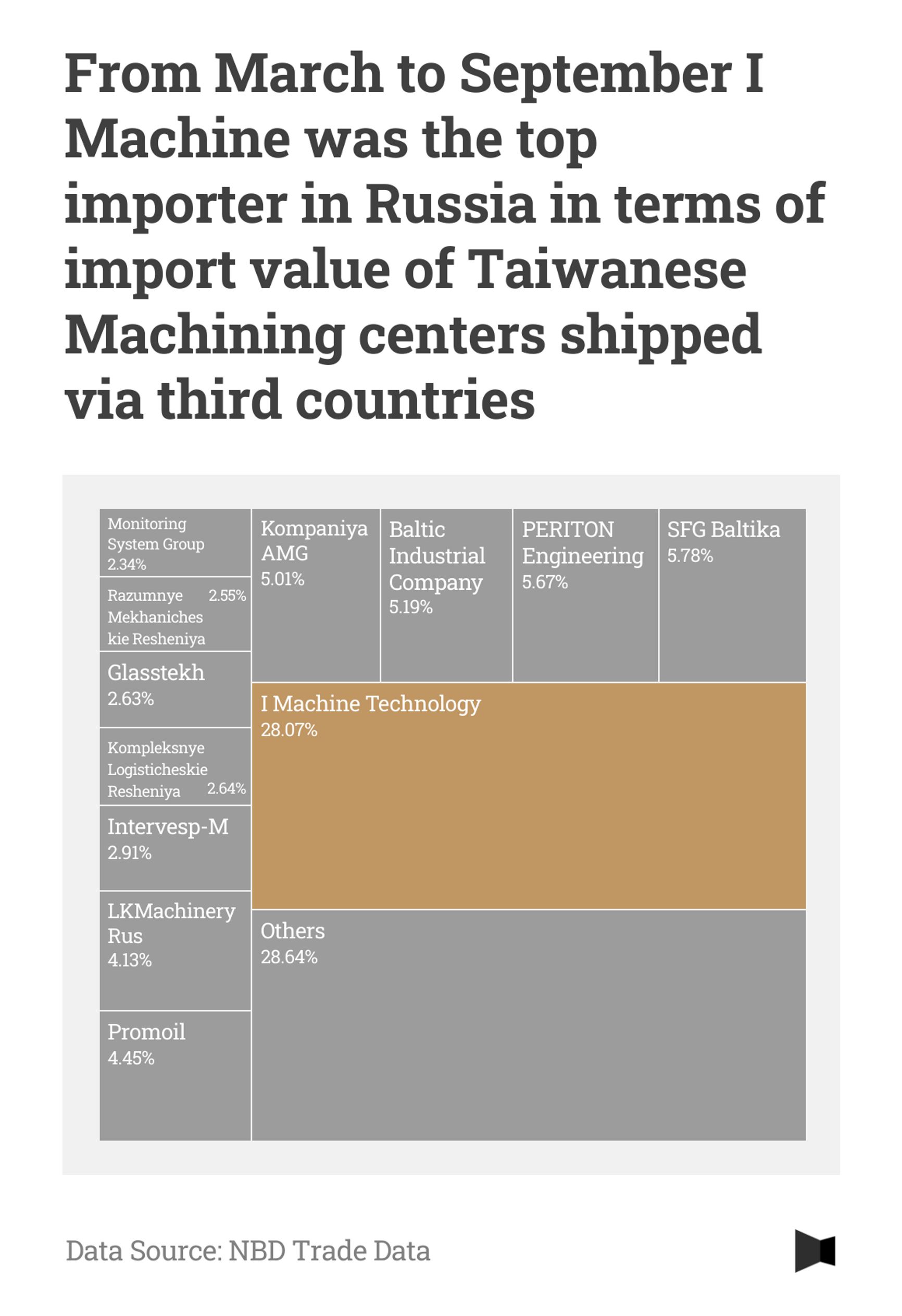

In the course of its investigation, The Insider also discovered the Russian importer engaged in the lion’s share of the machine tools sanctions evasion business. Among all of the Russian companies that procured Taiwanese machine tools via third countries in 2023, the one with the largest import volume was “I Machine Technology.”

Between March and October 2023, I Machine Technology imported at least $17 million worth of Taiwanese machine tools. Among them were 28 units shipped via Turkey, 37 via China and 16 directly from Taiwan.

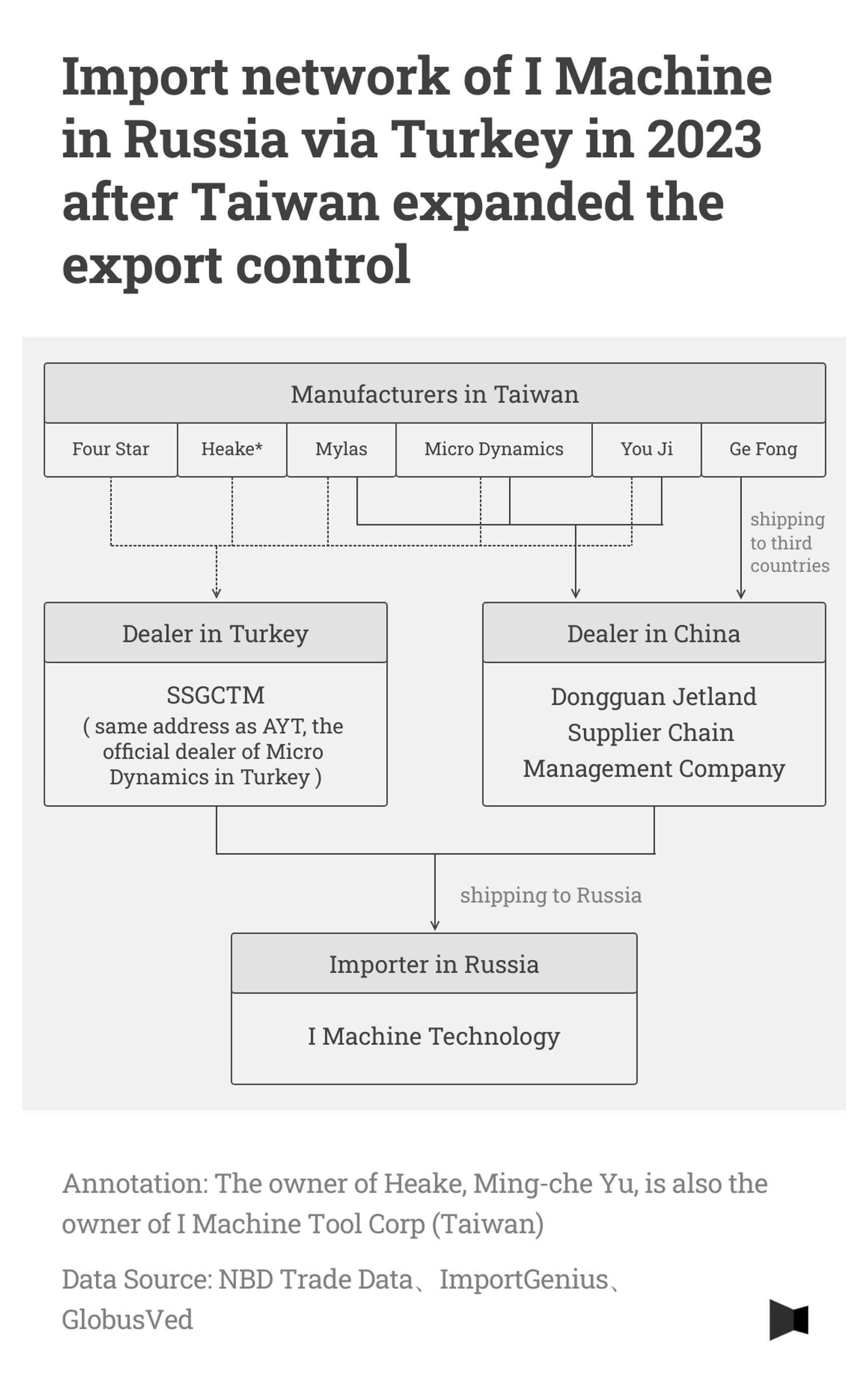

The Russian company works almost exclusively with a Taiwanese exporter of a similar name, “I Machine” (further referred to as I Machine Taiwan).

I Machine Taiwan is a trader established in 2008. It mainly represents Taiwanese brands of machine tools for export. The person in charge of the company is You Ming-Che. When Russia's I Machine Technology was established in February 2011, You Ming-Che was one of the stakeholders, owning 30% of the company's shares until November 2015.

In an interview with Taiwanese media outlet The Reporter, You Ming-Che stated that after the Taiwanese government expanded its restrictions on the export of machine tools to Russia, he no longer “cooperated” with I Machine Technology (Russia). However, again according to You Ming-Che, he still maintained a friendly relationship with the Russian company. You Ming-Che also pointed out that, due to the expansion of Taiwanese sanctions in early 2023, it was inevitable that Russia would begin looking elsewhere to meet its demand for high precision machine tools. However, You Ming-Che said that he was not a party to the Russian company’s sudden pivot to Turkey and China.

The Insider has attempted to reach out to I Machine Technology (Russia).

Despite their relative importance, the two “I Machine” companies are not the only ones involved in the sanctions evasion scheme. The Taiwanese machine tools shipped from Turkey to Russia were supplied by a Turkish trader called “SSGCTM.” SSGCTM only exports to one country, Russia, and all of the machine tools SSGCTM supplied to Russia in 2023 were of the same Taiwanese brands that I Machine Taiwan had exported directly to Russia in 2022. Notably, the registered address of SSGCTM is the same address registered to another well-known machine tool dealer, AYTT.

Russian company Kometa pays an unusually high price for Taiwanese machines

According to the Russian state procurement database, in September 2023 the Russian state-owned military-industrial enterprise “Korporatsiya Kometa” purchased a five-axis machining center BX900T manufactured by Taiwanese company Pinnacle. The sale certainly should have raised red flags, as 89% of Kometa's shares are controlled by Russia's most important military-industrial group, the US-sanctioned “Almaz-Antey.”

Also of note was the price Kometa paid for the Pinnacle machine, which is listed in the contract as having been purchased for 97.74 million rubles (approximately $1 million). The middleman in the September sale was the Moscow-based trader “Kompaniya AMG” (Компания АМГ). Between March and July 2023 — after Taiwan had expanded its export controls — Kompaniya AMG obtained 9 Pinnacle machines through traders in the United Arab Emirates, Turkey and China. The unit price of these Pinnacle machine tools purchased by AMG and imported into Russia was markedly lower than that paid in September, ranging from $60,000 to US$180,000.

An industry insider who did not wish to be named noted that the BX900T is not a particularly large model and concluded that the price Kometa paid for its September purchase was unreasonable. The fact that the sale occurred suggests that dealers who can still find a way to get machines onto the Russian market are selling them at a significant markup.

The Insider attempted to reach out to Korporatsiya Kometa and to Kompaniya AMG. None of Kometa’s officially listed addresses turned out to be valid.

The Reporter had better luck working from the Taiwanese side. The head of Pinnacle Machinery's Russian business, Huang Zhenglong, responded to The Reporter’s request for comment by claiming that AMG had indeed been Pinnacle's agent in Russia, but that following the Taiwanese government’s expansion of export controls in January 2023, Pinnacle was no longer exporting to Russia.

According to Huang Zhenglong, AMG had even admitted that it was involved in trading Chinese-made models disguised under Pinnacle’s brand “in order to sell them more easily and at a better price.” An industry insider who spoke with The Reporter was skeptical about Huang Zhenglong’s story, saying that “if the manufacturer really wants to sell it at a high price, why not just put a Japanese brand on it?”

It is worth noting that Amegino FZE, an UAE trader that supplied Pinnacle machine tools to AMG in 2023, has also been included in the sanctions list by the U.S. Treasury Department. The Reporter repeatedly asked Pinnacle whether it had supplied goods to Amegino FZE and whether it was aware the Russian company was subject to sanctions, but as of the time of publication, no reply had been received.

Taiwanese-made electrical discharge machine units flow into sanctioned institutes

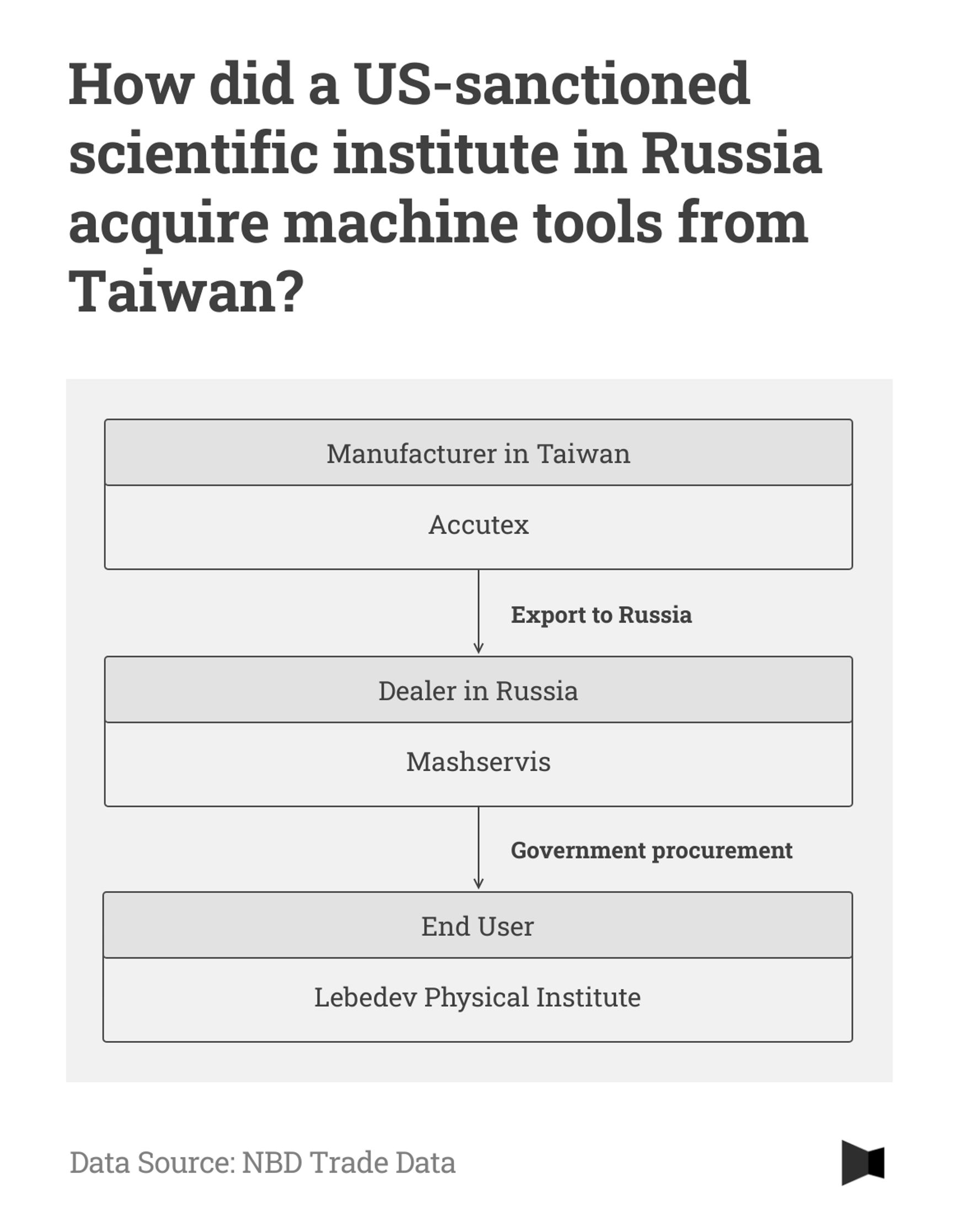

In addition to the Pinnacle case, other purchases exposed by Russian public procurement data reflect further potential gaps in the current export control regime. From April to May 2023, Russia’s Lebedev Physical Institute — which is under U.S. sanctions — purchased wire-cut electric discharge machines made by Taiwan’s Accutex via Russian importers “Mashservis” and “Vybor”.

The Insider has confirmed that, between February and July 2023, Mashservis did indeed import 8 Accutex electrical discharge machines, at unit prices ranging from US$65,000 to US$80,000. Vybor, however, has never appeared in Taiwan’s machine tool trade data.

Evan Huang, special assistant to the general manager of Accutex Technology, told The Reporter that the electrical discharge processing machines produced by Accutex do not fall within the scope of export control, meaning there is no need to apply for a special export license, and so the machines can be exported to Russia openly.

Regarding the procurement of Accutex machines by the sanctioned Lebedev Institute of Physics, Huang said that Accutex was not aware of any transaction involving the Institute. He added that, although Mashservis is indeed a long-term agent of Accutex, the Taiwanese company is not affiliated with Vybor in any way.

The Insider reached out to Mashservice, which confirmed that it had “...purchased the AL-400SA machine from the Taiwanese manufacturer Accutex” and supplied it to the Lebedev Physical institute. “Lebedev Physical Institute was indicated as the end user when purchasing from Accutex. Taiwan's sanctions laws were complied with during this purchase and were not violated,” the company says as, formally this type of machining tool may indeed be exported into Russia.

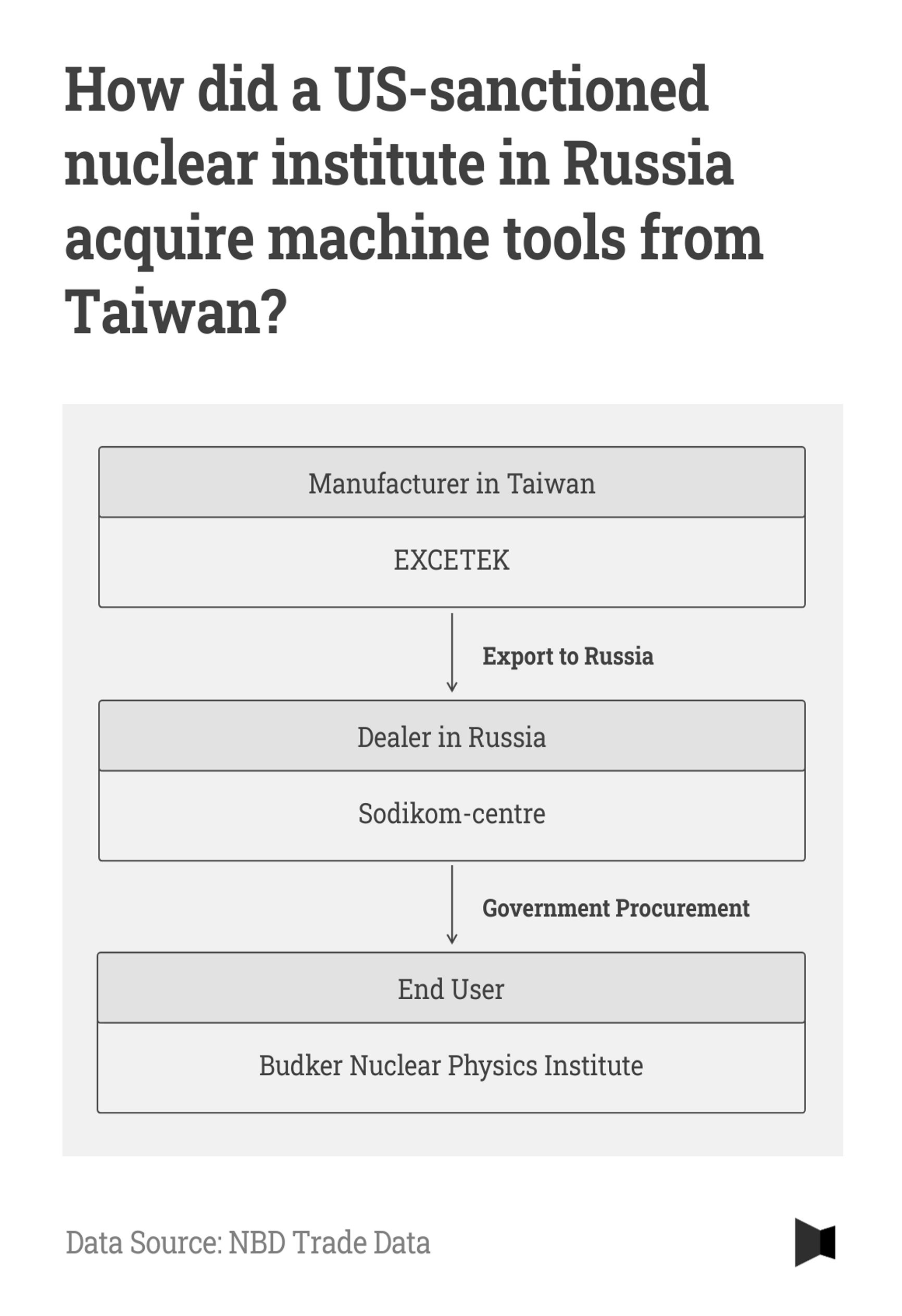

Another electrical discharge processing machine manufacturer in Taiwan, Excetek, was involved in a similar case. According to Russian public procurement data, the Budker Nuclear Physics Institute — also included in the sanctions list compiled by the U.S. Department of the Treasury — purchased Excetek’s “NP600L” and “VG500” from the importer Sodikom-Tsentr in June 2023.

Judging from the records of the trade data platform NBD, Sodikom-Tsentr did import an electric discharge machine equipped with a numerical controller to Excetek in May 2023. The Insider reached out to Sodikom but had not received a reply at the time of publication.

In an interview with The Reporter, the manager of Excetek’s business with Russia, Mr. Chen, said that after the Ministry of Economic Affairs expanded export controls in January 2023, Excetek sent its export models to Taiwan’s Industrial Technology Research Institute for approval. According to the Institute’s report, the two wire cutting machines that appeared in the procurement record did not fall under the scope of Taiwan’s export control.

In addition, Mr. Chen said that although Sodikom-Tsentr is indeed a long-term cooperative agent of Excetek, Excetek is not aware of any procurement related to the Budker Institute of Nuclear Physics, and that the Taiwanese manufacturer will once again urge Sodikom-Tsentr not to sell its products to sanctioned buyers.

Mr. Chen also emphasized that it is not easy for Taiwanese manufacturers to control the flow of machines: “The customer list is the agent's business secret, and they are also afraid that the Taiwanese manufacturer will contact the end buyer directly, in which case the agent will not make any money.”

What can be done to end the export of Taiwanese machine tools to Russia

While the measures taken by the Taiwanese government since January 2023 have made it more difficult — and more expensive — for Russia to import the technology that feeds its military-industrial complex, the problem of Taiwanese-made machine tools falling into sanctioned entities’ hands remains far from solved.

In order to remedy this reality, Sergei Guriev, Professor of Economics and Provost at Sciences Po, Paris believes that Taiwan’s sanctions regime must become stricter:

“The Taiwanese manufacturers realize that it is illegal to ship high-end equipment to Russia. This implies that intermediaries that help circumvent the sanctions charge very high fees – which is good, as this deprives Putin’s war machine of resources. But more must be done. We should keep on tracing the intermediaries who ship the equipment to Russia and demand the US and EU to impose sanctions on them. In the event that Taiwanese manufacturers knowingly and deliberately participate in circumvention of sanctions, they should also be punished.”

Still, focusing on the role of Taiwan alone may not be sufficient. Dr. Maria Shagina, Diamond-Brown Senior Research Fellow for Economic Sanctions, Standards and Strategy at the International Institute for Strategic Studies (IISS), pointed to the importance of taking action aimed at cutting off the flow of technology entering Russia via third-country intermediaries, NATO member Turkey chief among them:

“The EU-US-UK joint visits to the country seemed to bear fruit when Ankara pledged to clamp down on the circumvention problem. At the same time, the US in particular doesn't shy away from sanctioning Turkish entities and procurement networks. The goal is to raise stakes and deter future evasion.”