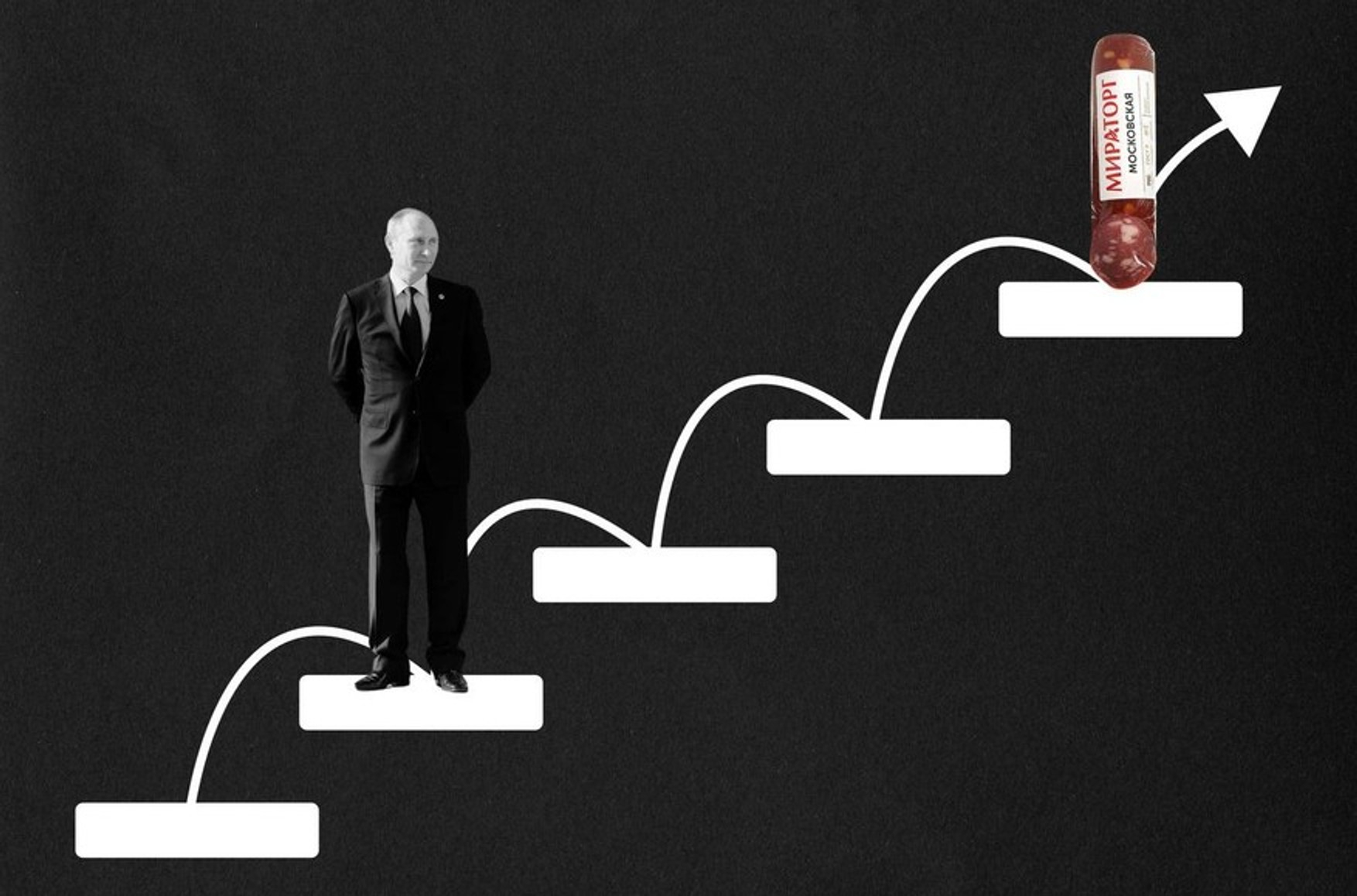

During the November meeting addressing economic issues, President Putin highlighted a continuous rise in the Russian GDP, a sentiment echoed by the head of the government and the Ministry of Economic Development. While, on paper, the GDP is experiencing growth, these encouraging figures, set against the backdrop of transitioning from a market to a military economy (with state orders taking precedence), fail to signify an improvement in well-being or genuine production expansion. Examining other measurable indicators, such as the purchase of cars, reveals that the current year, while an improvement over the previous one, still demonstrates a significant decline compared to pre-war times. Moreover, while statistics excel in measuring the quantity of goods, they lack the capability to assess quality adequately. Hence the observable shift in the array of products offered toward lower-quality alternatives, marking one of the responses to the crisis and sanctions.

Content

The fine line between the real and the nominal

Lies and Statistics in Wartime

Same quantity, lower quality

The fine line between the real and the nominal

Rosstat has issued a preliminary assessment, indicating a 5.5% increase in the Russian GDP in the third quarter of 2023 compared to the previous year. This echoes the optimistic sentiments expressed earlier by the Minister of Economic Development, the head of the government, and President Putin himself. The European Commission and the IMF are also adjusting their forecasts for the trajectory of the Russian economy. However, it is essential not to ascribe undue significance to these figures.

In typical circumstances, GDP dynamics serve as a key gauge of economic growth. Economic growth, in essence, denotes an augmentation in the genuine value of goods produced over a specific period compared to another. Yet, real value is not quantified in fixed units. For instance, if an individual's income was 60,000 rubles in 2022 and increased to 62,000 in 2023, it constitutes a nominal rise rather than a real one, given the diminished value of the ruble in 2023 compared to 2022. To ascertain whether real income has grown, one must understand how much the value (purchasing power) of the ruble has changed over the year. However, measuring the overall price level is a rather intricate task, addressed only in an approximate manner.

To ascertain whether real income has grown, one must understand how much the value of the ruble has changed over the year

Firstly, there is a vast array of different goods and services, each with its own price dynamics. Secondly, in various parts of the same city, identical items may be simultaneously sold at different prices; for instance, one store may offer an item for 1,900 rubles, while another sells it for 1,500. Thirdly, it's always difficult to categorize products.

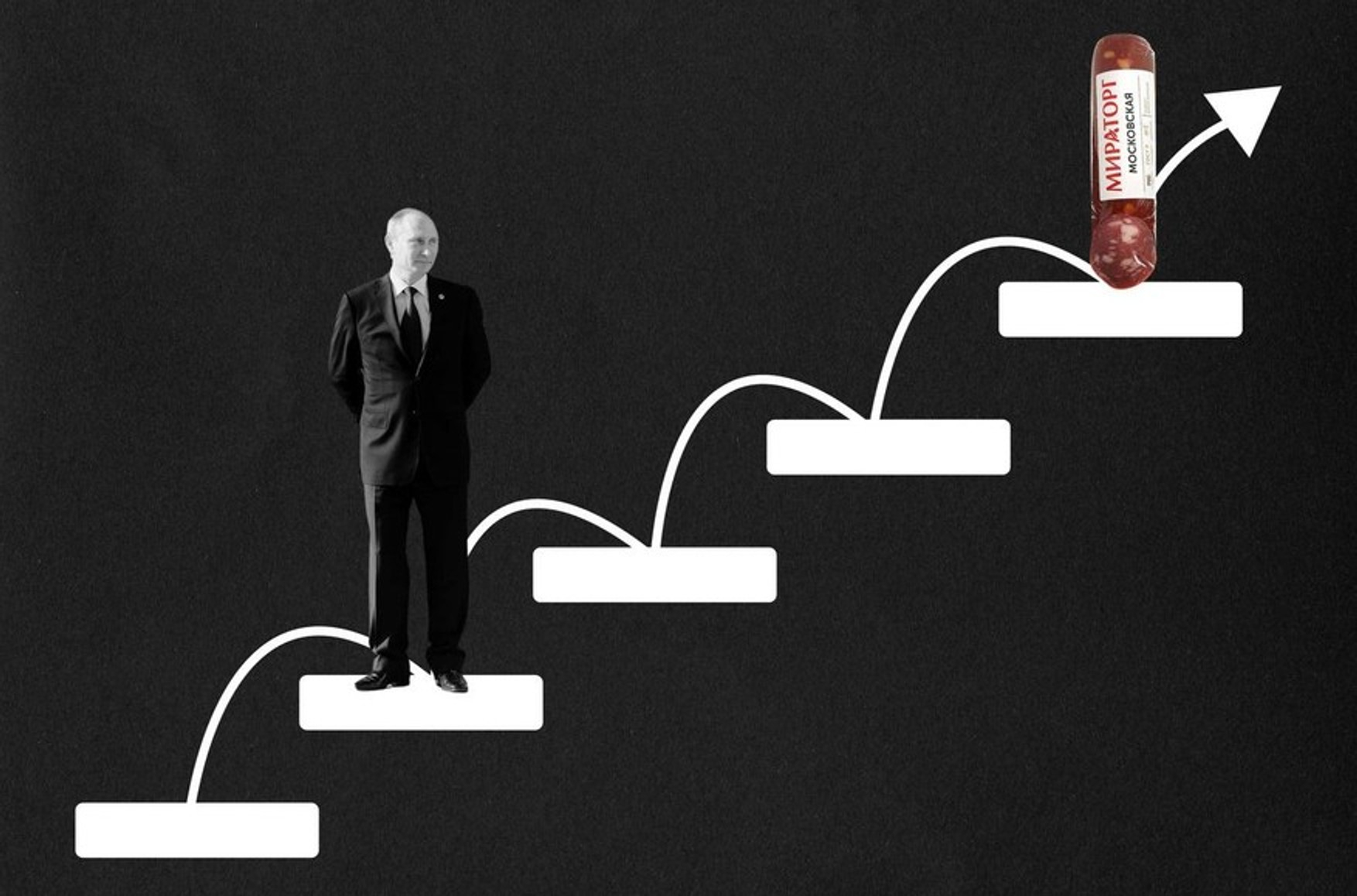

It is common knowledge that various products can be labeled as “sausage,” with prices varying significantly, if not exponentially. Yet, in the largest set of goods and services used by Rosstat to monitor prices, comprising only 556 items, all the diversity of sausages is encapsulated in just three categories: “semi-smoked and boiled-smoked,” “dry-smoked,” and “boiled.”

The situation is even more challenging with women's dresses. There are only two categories: “women's dress (dress-suit) made of semi-woolen or mixed fabrics” and “women's dress (dress-suit) made of cotton or mixed fabrics.” If the most expensive varieties disappear from the market and the cheaper ones become more expensive, the price index might inaccurately reflect that, on average, items in this category have become cheaper.

What about new types of products and services that emerge every year in a normally growing economy? They either have to be ignored or included under one of the existing categories by altering its content. Either way, the comparability of the items being compared is seriously compromised. And this is true only in peaceful and stable conditions. In times of abrupt structural shifts, such as when a closed economy becomes open or vice versa, the informativeness of GDP and price index statistics is further eroded.

Lies and Statistics in Wartime

Let's consider a hypothetical example. Last year, the economy produced 2 tons of bread and 1 ton of butter. Bread sold for 500 rubles, and butter for 1,000 rubles per ton. One might say that the production value for the last year was 2 x 500 + 1 x 1,000 = 2,000 rubles. This year, again, 2 tons of bread were manufactured, but they stopped producing butter and made 10 cannons. The price of bread increased, now sold at 600 rubles per ton instead of 500. The government acquired the cannons for 200 rubles each. The total nominal production value amounted to 2 x 600 + 10 x 200 = 1,200 + 2,000 = 3,200 rubles. This is 60% more than the previous year.

To assess the real production dynamics, we need to subtract the rate of price growth from this value. The only commodity sold both last year and this year is bread, which increased in price by 20%, from 500 to 600 rubles per ton. Therefore, we estimate inflation at 20%, subtract this value from the nominal growth of 60%, and obtain “real growth” of 30% per year.

The example can be further complicated by assuming that the production of cannons was not zero last year, and that butter hasn't not completely disappeared this year. In this case, we would need the specific weights of different goods to calculate the price index, and they could be assessed differently. However, the essence of the situation remains unchanged. The remarkable indicator of growth conceals a glaring and unpleasant fact for the populace: they used to eat bread with butter, and now they do without butter. And not because they voluntarily gave up butter in favor of cannons.

Populace doesn't purchase cannons on the market; the government does it through state orders, buying essentially from itself. Members of the public can only participate as labor, and even their earnings in artillery plants are just a portion of the amount taken from the private sector through taxes and directed toward government procurement.

In the Russian context, asserting that the federal budget, approved by the State Duma, mirrors the preferences of citizens who ostensibly seek militarization consciously is, frankly, absurd. The mere fact that a substantial portion of the budget, particularly the military allocation, is classified speaks volumes. Unlike the historical scenario in England during the Crimean War, where Chancellor of the Exchequer Gladstone delivered five-hour budget reports to Parliament, captivating the audience with dry figures that he could “connect with real life, elevate them almost to the level of poetic images,” our current situation lacks such transparency and eloquence.

A substantial portion of the budget, particularly the military allocation, is classified

Even from the perspective of a militaristic state advocate who genuinely prefers cannons over butter, such economic growth is dubious. In our example, the government, which did not purchase cannons before, ordered 10 artillery pieces in the new year, paying 200 rubles for each of them. Does this reflect the growth of the country's overall production capacity, allowing for the accumulation of armaments (assuming that makes sense)? Not necessarily. The prices the government pays for cannons are not market-driven. They do not result from the amalgamation of millions of individual preferences tied to information about the desires and capabilities of the public. Government procurement prices are often arbitrary or influenced by administrative-political maneuvers. They can often be multiples higher than prices at which analogs are sold on global markets.

It's easy to imagine that a cannon the government buys for 200 rubles could cost only 50 rubles on the world market. This might be due to the inefficiency of the domestic producer, whose production costs are unreasonably high. Alternatively, it might not be the producer's fault but that of their suppliers or associates. The cost could be normal, but the markup enormous. A clerk in the ministry might have made a mistake and jotted down the wrong figure. Or, corruption and falsehood might prevail at every level in a closed, isolated, unaccountable system.

The question is, what would the calculated economic growth rate look like if each cannon were valued not at 200 rubles but at 50? By recalculating the nominal aggregate income, we would get 2 x 600 + 10 x 50 = 1,200 + 500 = 1,700 rubles, a decrease of 15% relative to the previous year. Subtracting 20 percentage points as an adjustment for inflation, we end up with a real product reduction of 35%. This is not surprising since the production of butter, which accounted for half of the economy last year, disappeared altogether, and the cannons replacing it are not as valuable.

If a cannon costs 50 rubles, then to replace the vanished ton of butter, 20 cannons are needed, even if viewed through the eyes of a militarist who considers these cannons a good and is willing to pay for them out of their own pocket. Only then could one say that the economy has not contracted. However, in Russian conditions, there are no reliable data on the quantity of purchased weapons, the actual prices of purchases, or the benchmark prices of the global market (because suppliers dislike being compared with others and strive to deliver as much “unique” product as possible). Only a naive person could believe that they are being presented with an objective picture of economic upturn.

Economic upturn, if not a statistical trick, should be accompanied not only by GDP growth but also by improvements in other indicators reflecting the standard of living and economic development. These include natural-economic indicators (such as the volume of electricity production, transportation turnover, car sales), cost indicators (such as the stock market capitalization), and socio-demographic indicators (average life expectancy, mortality rate).

Considering the entire set of these indicators, it is more accurate to say that the state of the Russian economy in 2023 is slightly better than in 2022 but noticeably worse than in the pre-war period. For instance, sales of new passenger and commercial vehicles for the first three quarters in 2021 were over 1.2 million, in 2022 - just over 500,000, and in 2023 - around 700,000.

Economic upturn, if not a statistical trick, should be accompanied not only by GDP growth but also by improvements in other indicators

If we take a closer look at the industry structure of the Russian economy and identify the segments that made the greatest contribution to the claimed 5.5% GDP growth according to Rosstat, it turns out that the most dynamic were the production of “computers, electronic, and optical products” (production index 134%) and “other transport vehicles and equipment” (131%). This is what the “cannons” refer to. Almost certainly, the growth in these positions is entirely fueled by state military orders.

Same quantity, lower quality

Of course, it's logical to ask where the vanished “butter” went. And to this question, we won't find a clear answer in official Russian statistics. The leadership of Rosstat will face consequences if it shows a clear decline in the production and consumption of some important goods and writes about it in terms that journalists can understand. Accounting is done in fairly broad categories that simultaneously include high and low-quality products. If there is less good-quality production and more low-quality, the volume in natural terms may remain unchanged. And if there is also a rise in prices at the same time, there won't be a decline in value terms.

Most likely, the degradation of the Russian economy often occurs precisely in this form—and therefore remains elusive for statistics. Many people have started using lower-quality products—some due to savings and fear for the future, some because of a reduction in real incomes, and some because the products they are accustomed to have simply disappeared.

Probably, in almost every household and at every enterprise, except those directly involved in the war effort and enjoying privileges from the state, one can tell stories of having to give up something good. Earlier, a person would see that there is “slightly worse” milk for 60 rubles and “better” milk for 70 rubles, and would choose the “better” one. And now, when the choice is between “slightly worse” for 70 and “better” for 80, they buy the “slightly worse” bottle for 70. For statistics, nothing has changed: just as before, a liter of the product “whole pasteurized drinking milk 2.5–3.2% fat content” is sold, and its price, as before, is 70 rubles. No decline, no inflation!

Here's how the Bank of Russia reported on this in its Trends Bulletin a year ago.

“Simultaneously, there is a likelihood that the supply of goods and services will decrease as the product range matrix shifts towards alternatives that were either absent or inadequately represented in the Russian market before. This shift is expected to coincide with a decline in the average quality features of goods and services, encompassing consumer properties, functionality, durability, service support, and more. Consequently, with a more limited array of goods available for sale, the overall reduction in production volumes ('in pieces') will be mitigated. This leads to a shallower economic downturn than could be anticipated in the absence of opportunities for diversifying the product range.”

Of course, this is just a possible scenario and a rough explanation. It cannot be denied that even today in Russia, many people invest, make a profit, and expand their business. In addition to the system of state parasitism in the economy, there is a healthy private entrepreneurial foundation. Some segments of it continue to grow despite everything, while others contract under the weight of the burden placed on them.

The hypothesis of a widespread decline in quality, masked by statistical generalizations, requires a large number of specific illustrations. Changes in the structure of production and consumption are a complex phenomenon that is difficult to track and objectively describe. But today, independent economists should pay attention precisely to these processes. Less importance should be given to official aggregated data, and more focus should be on individual industries and markets, supply chains, and product ranges. Such observations will generate more interest among the public.

Indeed, the official optimism emanating from the authorities is encountering a rising discontent among consumers. It's not so much the economy that is flourishing as it is a sense of confusion. This parallels the situation in the late Soviet era when statistical compilations portrayed continuous improvement, dissent against the official narrative was rare, yet beneath the surface, a prevailing sentiment emerged: “We can't continue living like this; do whatever it takes, just bring it to an end.”