Customs data analysis carried out by The Insider shows that Russia actively imported machinery used for hot metal forming in 2024. Forging, stamping, coining, and other forms of metal processing that involve bending and shaping, rather than cutting, play a crucial role in both civilian and military industries.

The total value of forging and stamping equipment imported by Russia in 2024 totaled just under $265 million. The machinery included hydraulic presses, sheet bending machines, tube and panel bending machines, punching and cutting machines, rolling presses, and guillotines. Still, this marks a significant decline compared to 2023, when Russia imported similar machinery valued at $424 million.

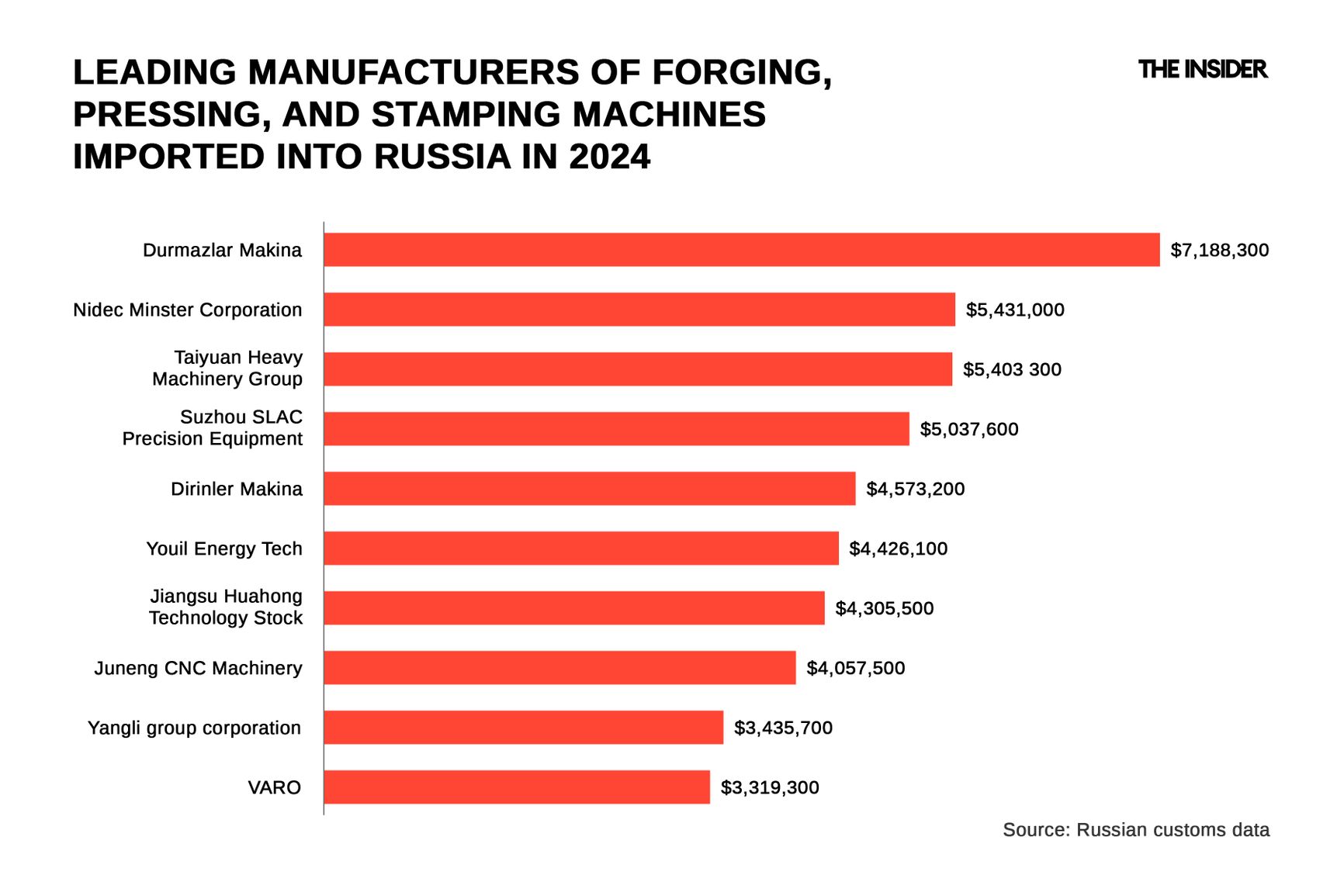

In 2023, key suppliers included Turkish brand Durmazlar and Italian brands Idromec and D.S.R. Sider. German manufacturers such as Alfons Haar Maschinenbau, Asmag-Anlagenplanung und Sondermaschinenbau, and Kohler Maschinenbau were also present in the market — though their sales volumes to Russia lagged behind those of their Italian competitors. By 2024, however, customs data indicates that Turkish and Chinese manufacturers had significantly displaced Italian and German brands in the Russian market.

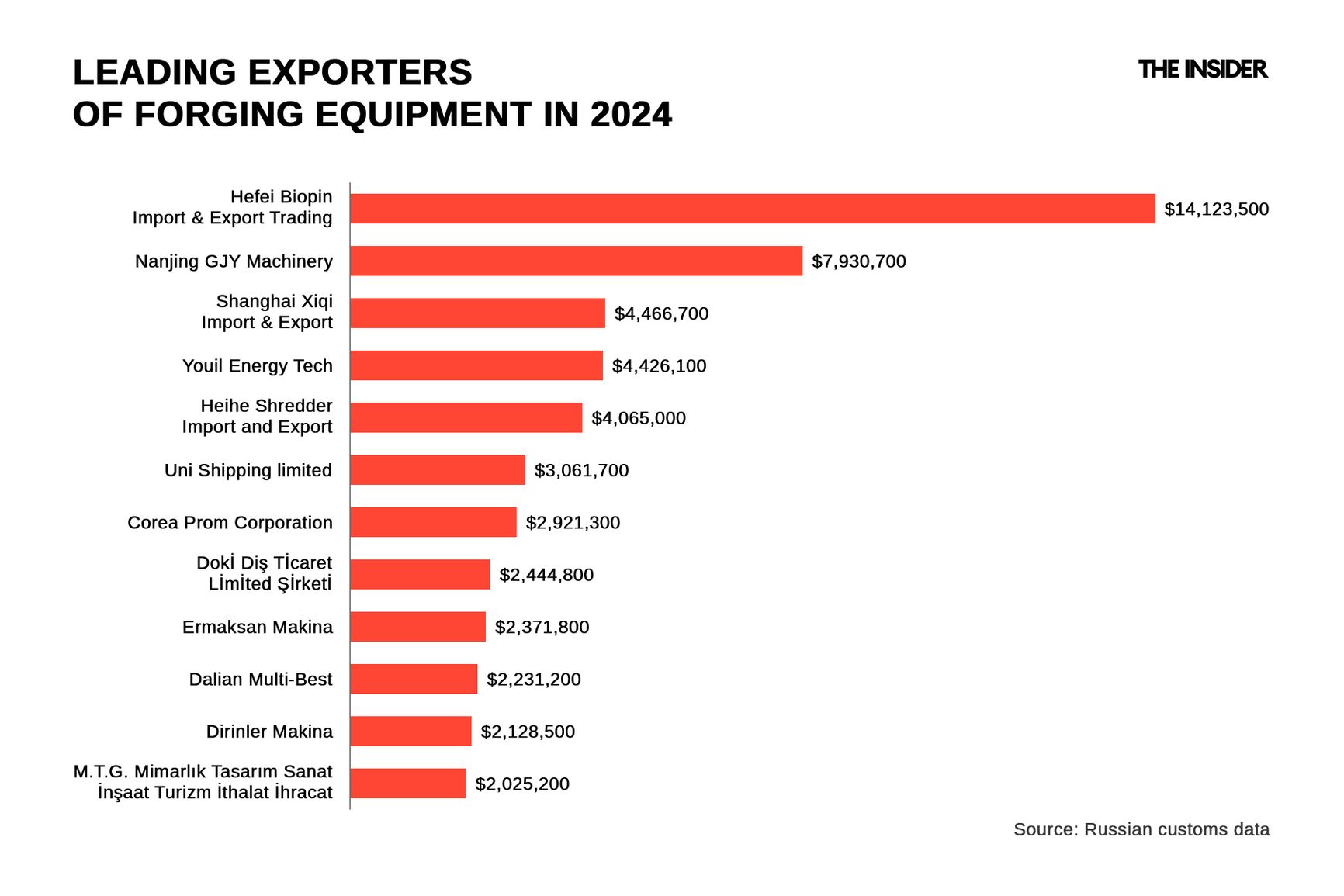

In 2024, Chinese manufacturers accounted for nearly all of Russia’s imports of forging equipment, with Turkish companies coming in second.

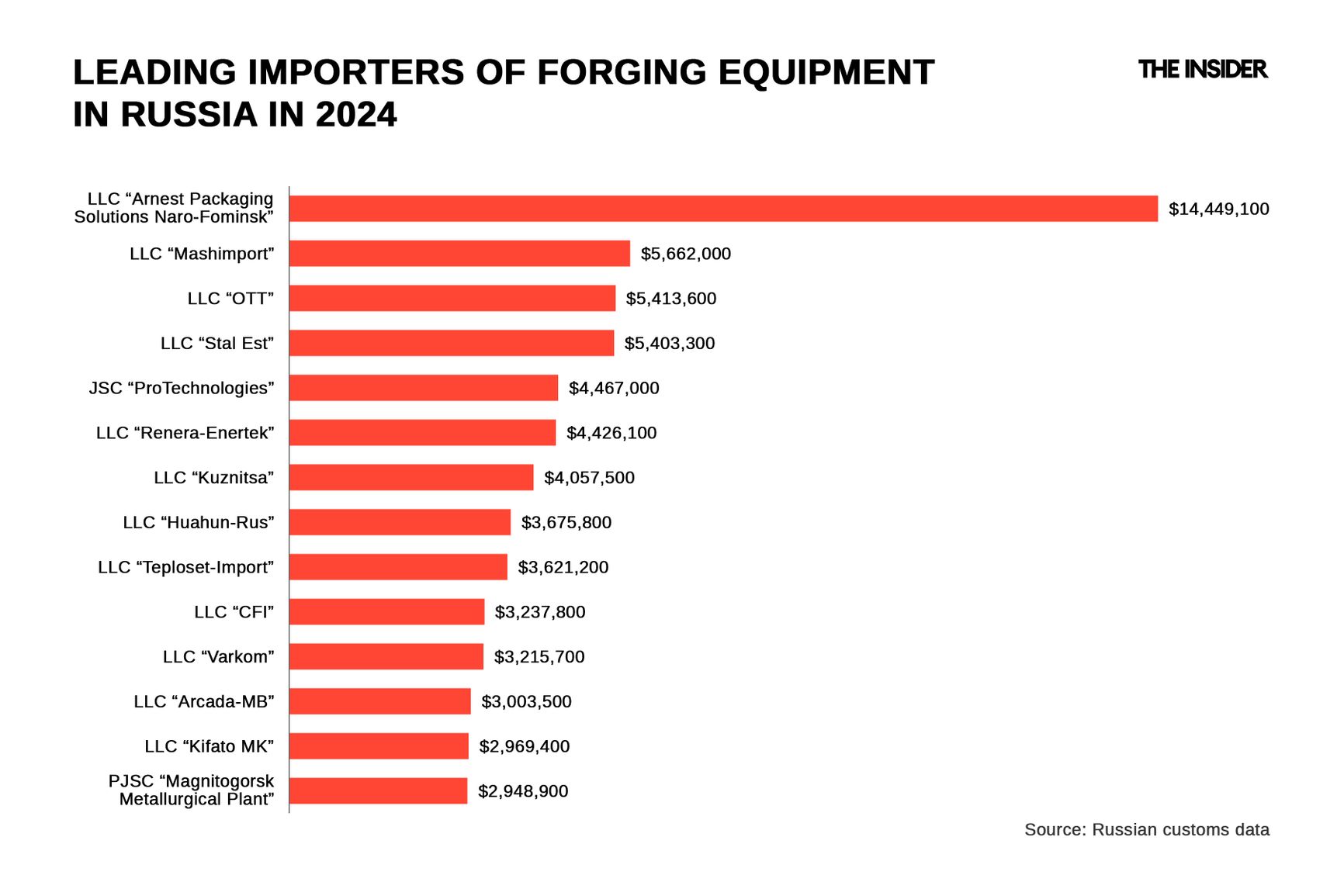

Russia’s top importers of this equipment in 2024 included both manufacturing firms and retailers/resellers. Among manufacturers, the key players were Arnest (an aluminum packaging producer), the Magnitogorsk Iron and Steel Works (one of the world’s largest steel producers), Teploset-Import (a supplier of fittings and reinforcement materials), and Kifato MK (which provides equipment for shops and warehouses).

Retailers with detailed catalogs on their websites included ProTekhnologii (АО «Протехнологии»), Kuznitsa («Кузница»), CFI («Сиэфай»), Barus Instrument («Барус Инструмент»), TD Vekprom (ТД «Векпром»), Intervesp («Интервесп»), and Stanki Optom («Станки оптом»). Additional distributors such as Mashimport («Машимпорт»), Stal Est («Сталь Эст»), Varkom («Варком»), Yugmettrade («Югметтрейд»), and Engineering Bureau («Инжиниринговое бюро») also played a significant role, along with logistics-focused companies like OTT («Отт») and STS-Logistics («СТС-Логистика»).

While all these companies operate as civilian businesses, many employ relatively simple technologies, such as bending thin metal sheets and rods to produce shelves, shopping baskets, shovels, and rakes, as well as cutting and shaping pipes.

European equipment continues to support Russian metallurgy

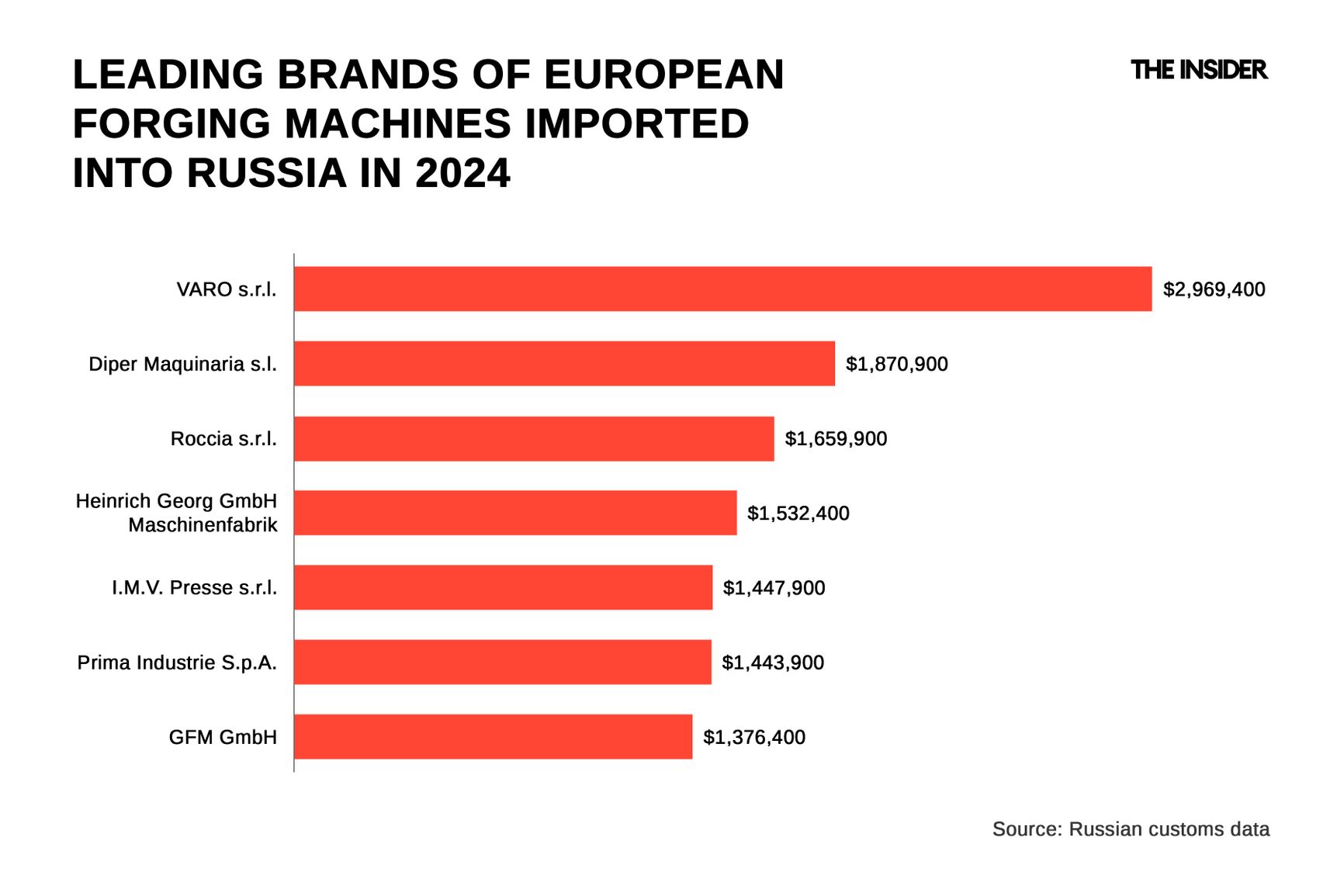

Although Turkish and Chinese companies dominated the supply of forging equipment to Russia in 2024, European brands still played a role. European machines are often more technologically advanced, though they are more expensive and are harder to obtain under current conditions. As a result, the volume of European forging equipment imports remains significantly lower than that of Chinese and Turkish manufacturers.

The leading European brands in the Russian market were Varo (Italy), Diper Maquinaria (Spain), and Roccia (Italy).

Beyond their applications in producing cans, grocery store baskets, and shelving, machinery from these manufacturers has also been used by Russia’s defense industry. Previous procurement records, which in past years were more transparent, indicate that Kalashnikov Concern purchased a Roccia sheet bending machine for €500,000.

Sheet bending presses are also essential for shipbuilding and tank production. For example, a Faccin bending press was previously sought after by one of Russia’s largest ammunition manufacturers, the Cheboksary Production Association named after V.I. Chapaev (sanctioned by the U.S. in late 2023).

These shipments do not come directly from Europe, and the manufacturers themselves are not the direct exporters. Instead, unknown or intermediary companies from Uzbekistan and Turkey, often resembling shell companies, handle the export of European machinery to Russia. One exception in 2024 was the import of a hot metal forming press from the German company Lasco Umformtechnik GmbH (pictured below). This transaction was unusual because the press was shipped to Russia from Turkey, facilitated by the Swiss firm Presstrade AG.

Lasco Umformtechnik GmbH still lists an active Russian representative office on its website. However, in 2023, its 100% Russian subsidiary, Lasco Umformtechnik Service LLC, reported financial losses in its annual report.

The Insider reached out to Varo S.R.L., Diper Maquinaria S.L., Roccia S.R.L., Heinrich Georg GmbH Maschinenfabrik, I.M.V. Presse S.R.L., Prima Industrie S.P.A., GFM GmbH, Faccin S.P.A., Salvagnini, Prima Industrie, Lasco Umformtechnik, and Presstrade AG for comment.